Numero Vat Colombia

Www Pwc Com Gx En Tax Indirect Taxes Assets Guide To Vat Gst Sut In The Americas 18 Indirect Tax Guidance Of 21 Countries In The Americas Pdf

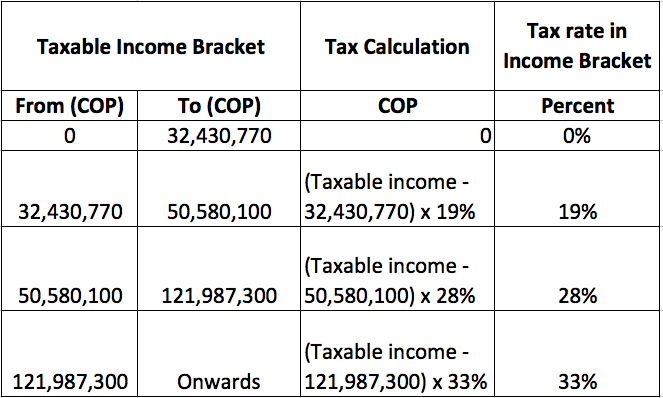

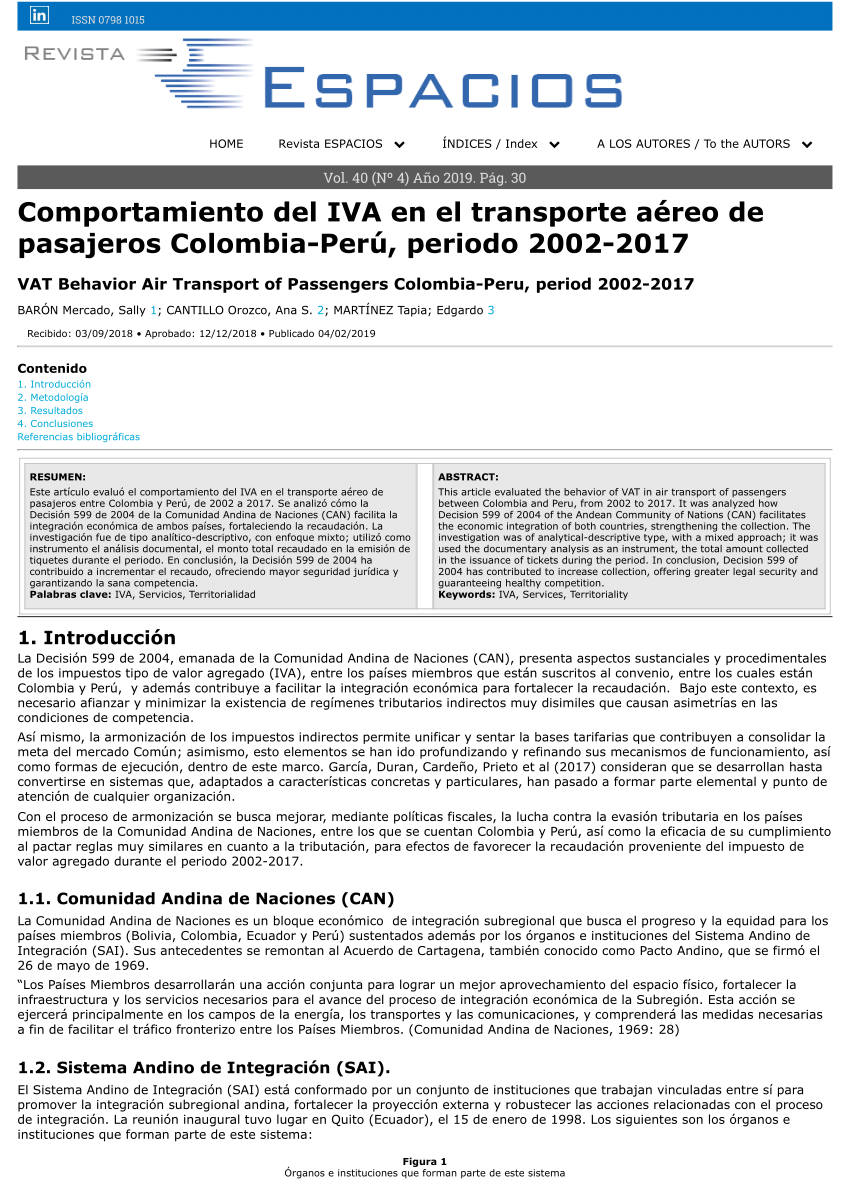

Filing Colombia Income Taxes 16 Update

Colombia Indirect Tax Guide Kpmg Global

Competition Adesignaward Com Document Download Php Id 143

How To File Income Taxes Declaracion De Renta In Colombia

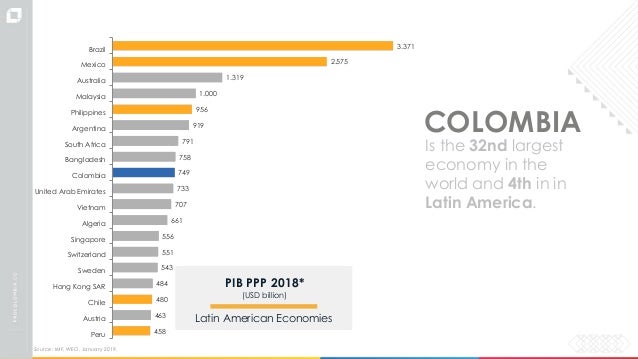

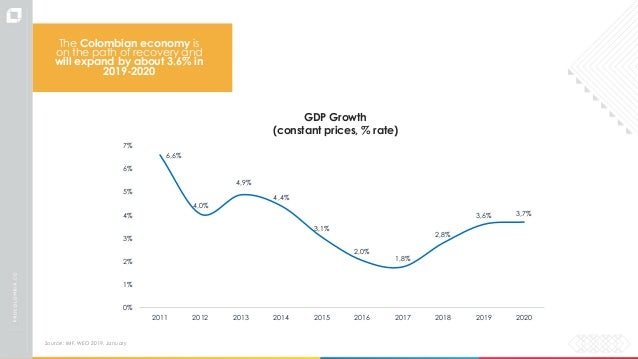

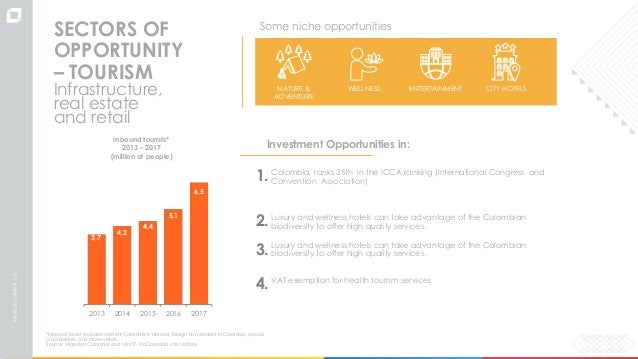

Colombia Presentation For 19

Colombia has a national Valueadded tax (VAT) of 16% as of 21, administered by the Dirección de Impuestos y Aduanas Nacionales (DIAN) Visit this page for an executive summary of Colombia's tax structure and rates, by SalesTaxHandbook.

Numero vat colombia. Foreign companies rendering taxable services from abroad are required to file VAT returns in Colombia (obligation to charge VAT started as of 1 July 18 while the obligation to file returns would start as of November 18);. Un número de registro de IVA es alfanumérico y consta de hasta 15 caracteres Las primeras dos letras indican el estado miembro correspondiente, por ejemplo, DE para Alemania Al introducir su número de IVA, deberá incluir las dos letras que identifican a su estado miembro de la UE (por ejemplo, DK para Dinamarca, EL para Grecia y GB para. The Sales Tax Rate in Colombia stands at 19 percent Sales Tax Rate in Colombia averaged 1680 percent from 06 until , reaching an all time high of 19 percent in 17 and a record low of 16 percent in 07 This page provides Colombia Sales Tax Rate actual values, historical data, forecast, chart, statistics, economic calendar and news.

In matematica, un numero colombiano è un numero intero positivo che non può essere espresso come somma di un altro intero positivo e delle cifre di quest'ultimo Esempio 21 non è un numero colombiano, in base 10, poiché 15 1 5 = 21;. Nevertheless, Law 1819 of 16 established that nonresident service providers rendering services from abroad must register for VAT purposes in Colombia when they sell vatable services to customers who are not registered for VAT purposes in Colombia Registration for VAT purposes does not necessarily mean the triggering of a PE Such obligation. La Comisión Europea emplea las dos expresiones VAT number y VAT identification number, en español, número de IVA y número de identificación de IVA Sin embargo, la Agencia Tributaria se refiere a él como el número de identificación fiscal (NIF) a efectos del IVA intracomunitario y opta por utilizar las siglas compuestas (NIFIVA) En las transacciones económicas entre empresas o.

Todos los empresarios que han decidido realizar operaciones a nivel europeo han oído hablar del número VAT, que no es más que un número o código que identifica a una empresa en el ámbito de la Unión EuropeaEs, por tanto, muy similar al NIF que tenemos en España, pero con un alcance distinto mientras el NIF identifica a la compañía dentro de nuestras fronteras, el VAT hace lo propio. National taxes National taxes are administered by the National Directorate of Taxes and Customs (Spanish Dirección de Impuestos y Aduanas Nacionales, DIAN) Some of these taxes include VAT The valueadded tax (VAT) is the main indirect tax Apparently, this is rising to 19 percent in 17;. Calle Las Mercedes, 31 3º 430, Getxo (34) 944 800 500 sbal@sbalnet Contacto.

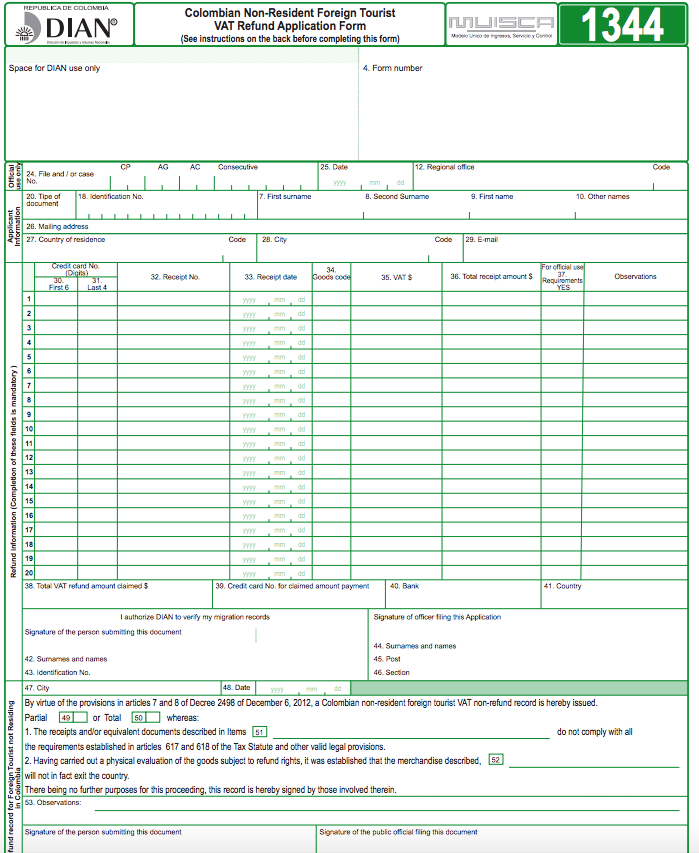

En Colombia, tengan vigente el Sistema Técnico de Control Tarjeta Fiscal 36 No Factura Escriba el número de la factura de la cual solicita la devolución del impuesto sobre las ventas por las compras de bienes gravados 37 Fecha factura Escriba la fecha de la factura de la cual solicita la devolución. In Colombia, each person is issued a basic ID card during childhood (Tarjeta de Identidad) The ID number includes the date of birth and a short serial number As of 03 created the NUIP (Número Único de Identificación Personal), starting the numbering per billion (1,000,000,000) Read more about this topic National Identification Number. This website uses 'cookies' to give you the best, most relevant experience Using this website means you’re Ok with this You can change which cookies are set at any time and find out more about them in our cookie policy.

Colombia has proposed raising its VAT rate from 16% to 19% as part of a package of measures to prevent the country losing its BBB credit rating following the sharp fall in global oil prices Colombia would also introduce VAT on electronic services provided to consumer by companies based outside of the country Th. Colombia VAT information Name of the tax Valueadded tax (VAT) Local name Impuesto sobre las ventas (IVA). Devoluciones de IVA a no establecidos (VAT Refund) IVA Telecomunicaciones, Radiodifusión, TV y Servicios electrónicos (OneStop Shop) Exenciones y devoluciones en el marco de relaciones diplomáticas, consulares, organismos internacionales y OTAN.

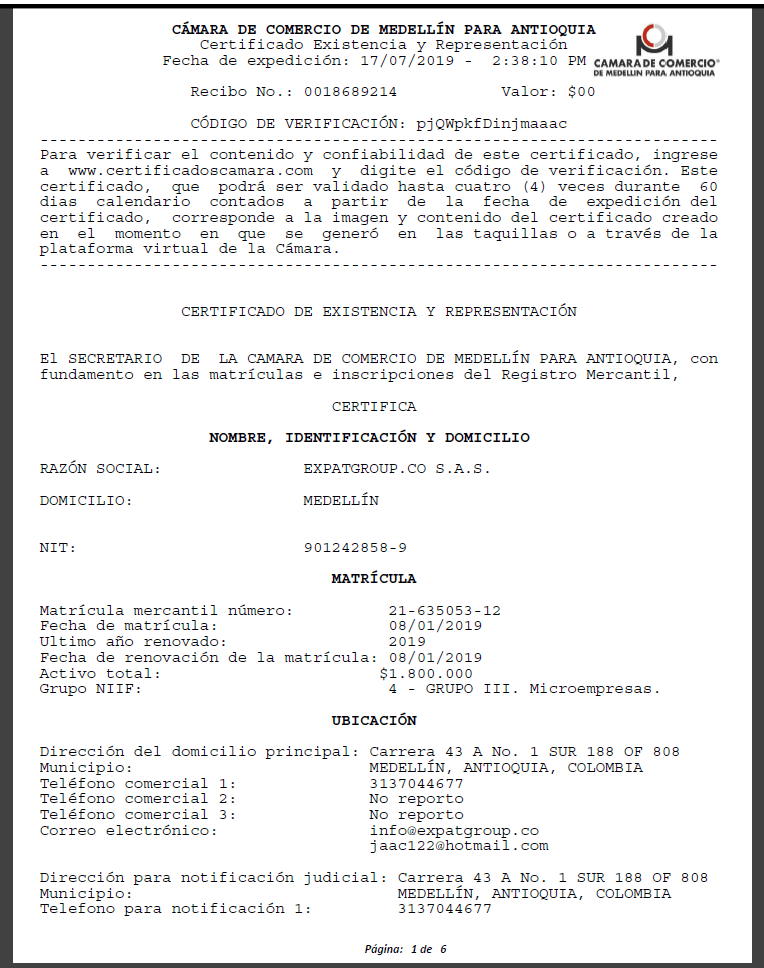

Without domicile in Colombia, responsible for sales tax (VAT, they may submit the application for the registration, updating or cancellation of the Single Tax Register (RUT) through the "PQSR and Complaints" service of the website of the Special Administrative Unit Directorate of National Taxes. Standard VAT rates for WWTS territories This table provides an overview of statutory VAT rates In instances where a territory has a consumption tax similar to a VAT, that tax rate is provided See the territory summaries for more detailed information (eg exempt items, zerorated items, items subject to a reduced rate, alternative schemes). A registered business will be provided with a Taxpayer Identifiaction Number (“Número de Identi cación Tributaria” – NIT There is no scope for voluntary VAT registration Deregisteration must be applied for within 30 days of stopping taxable supplies, and should be supported by the certificate of a public auditor.

Y un número de IVA extranjero o intracomunitario a. The Sales Tax Rate in Colombia stands at 19 percent Sales Tax Rate in Colombia averaged 1680 percent from 06 until , reaching an all time high of 19 percent in 17 and a record low of 16 percent in 07 This page provides Colombia Sales Tax Rate actual values, historical data, forecast, chart, statistics, economic calendar and news. Revisa tus registros Si el número que debes encontrar es el EIN de una empresa con la que hayas tenido negocios, podrías encontrarlo en las facturas de esa empresa o en otro tipo de documentación de las transacciones que hayas realizado con ella Por ejemplo, para recibir una deducción fiscal debido a que tienes hijos a tu cargo, puedes necesitar el EIN de la guardería o de la niñera.

En Colombia, tengan vigente el Sistema Técnico de Control Tarjeta Fiscal 36 No Factura Escriba el número de la factura de la cual solicita la devolución del impuesto sobre las ventas por las compras de bienes gravados 37 Fecha factura Escriba la fecha de la factura de la cual solicita la devolución. è un numero colombiano, perché non è ottenibile da nessuna somma come il precedente La caratteristica di essere un numero colombiano dipende. Answer 1 of 37 I would like to share this information with tourists so that they have a more positive experience than I did while attempting to claim the VAT tax on my purchases in Colombia Most shops add by law a 19% VAT tax If you are a foreign tourist and.

Si lo necesitas, puedes descargar una copia de nuestro formulario W9 y usar nuestro número de identificación de contribuyente (TIN, Taxpayer Identification Number) de los EE UU El Id de IVA de Dropbox International Unlimited Company es IE J. Answer 1 of 37 I would like to share this information with tourists so that they have a more positive experience than I did while attempting to claim the VAT tax on my purchases in Colombia Most shops add by law a 19% VAT tax If you are a foreign tourist and. Colombia has a national Valueadded tax (VAT) of 16% as of 21, administered by the Dirección de Impuestos y Aduanas Nacionales (DIAN) Visit this page for an executive summary of Colombia's tax structure and rates, by SalesTaxHandbook.

Zoom is the leader in modern enterprise video communications, with an easy, reliable cloud platform for video and audio conferencing, chat, and webinars across mobile, desktop, and room systems Zoom Rooms is the original softwarebased conference room solution used around the world in board, conference, huddle, and training rooms, as well as executive offices and classrooms Founded in 11. El Número de Identificación Fiscal (NIF) es la manera de identificación tributaria utilizada en España para las personas físicas (con documento nacional de identidad o número de identificación de extranjero asignados por el Ministerio del Interior) y las personas jurídicas 1 cita requerida El antecedente del NIF es el CIF, utilizado en personas jurídicas. VAT is the abbreviation of Value Added Tax VAT is in general due when goods and/or services are sold la dirección IP utilizada para comprar servicios digitales está en Colombia (3) el número de teléfono utilizado para la compra o el pago de los servicios digitales tiene el código de país de Colombia.

Vatglobal provides VAT compliance services for BroadSoft, Inc Vatglobal has always provided a professional and efficient service, including statutory VAT reporting and the associated compliance support I find their staff to be knowledgeable and proficient and it has always been a pleasure to work with them. Muy a menudo, el número de IVA será el único número de identificación fiscal en el país correspondiente Sin embargo, a veces, las autoridades fiscales pueden emitir dos números un número de impuesto local para las transacciones locales y comunicaciones con las autoridades fiscales;. Physically rendered in Colombia are subject to VAT Nevertheless, some exceptions are provided regarding services rendered from abroad by nonresidents to users or recipients located in Colombia, such as auditing, consulting, advisory and licensing of intangible goods, which are considered to be rendered in Colombia and therefore levied with VAT.

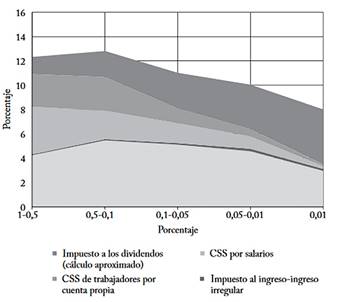

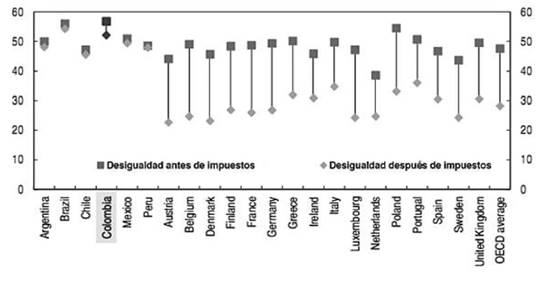

VAT halfempty Colombia tries to fix a messy and unfair tax A scheme to help the poor, and raise more revenue for the government The Americas Oct 17th edition Oct 17th. A value added tax identification number or VAT identification number (VATIN) is an identifier used in many countries, including the countries of the European Union, for value added tax purposes In the EU, a VAT identification number can be verified online at the EU's official VIES website It confirms that the number is currently allocated and can provide the name or other identifying. Foreign companies rendering taxable services from abroad are required to file VAT returns in Colombia (obligation to charge VAT started as of 1 July 18 while the obligation to file returns would start as of November 18);.

Colombia VAT information Name of the tax Valueadded tax (VAT) Local name Impuesto sobre las ventas (IVA). Colombia’s consumer confidence sank to a record low in January last year, after the government of President Juan Manuel Santos raised VAT to 19 percent from 16 percent. VAT returns are bimonthly in Colombia for businesses with revenues of 3 billion pesos per annum For smaller taxpayers, returns are quarterly The penalty for late VAT returns and payments is 5% of the value of the VAT due.

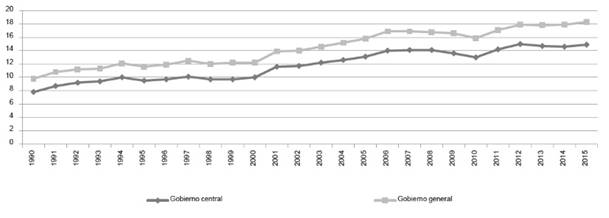

Dicho número, VAT o NOI, es el NIF del empresario, pero añadiéndole las siglas denominativas del país al que pertenece, es decir, en el caso de España, ES previamente al NIF En consecuencia, si tú NIF es B tu VAT o NOI será ESB Tramitar y conseguir VAT. 2 up to the end of 16 the tax was 16 percent of the price of merchandise, goods and services with some exceptions public transportation , water supply and sanitation and the transportation of natural gas and hydrocarbons. La Value Added Tax (VAT) è un'imposta indiretta che viene addebitata sulla maggior parte dei beni e dei servizi forniti dalle imprese registrate ed operanti nel Regno UnitoEssa è dovuta anche per i beni ed alcuni servizi che sono importati da Paesi al di fuori dell'Unione Europea (UE) e su quelli importati nel Regno Unito che provengono da altri Paesi dell'UE.

Un número de teléfono virtual DID de Colombia te permitirá tener presencia en sus principales ciudades aunque estés en otro país Recibe las llamadas de tu linea telefónica virtual de Colombia en cualquier ordenador portatil, Pc, dispositivos voip, softphone app para teléfonos inteligentes, o a través de desvío de llamadas directamente a tu fijo o móvil. Mientras que este número de identificación te será válido para comercializar productos y servicios en España, a nivel europeo necesitarás el VAT para poder hacerlo Cómo conseguir el VAT La concesión o no de este número identificativo dependerá de la Comunidad Autónoma en la que residas. Colombia issues regulation on voluntary VAT collection system for foreign service providers of digital services Foreign service providers of digital services may elect to be subject to a new valueadded tax (VAT) withholding system under which they will no longer be responsible for collecting the VAT on the provision of digital services to.

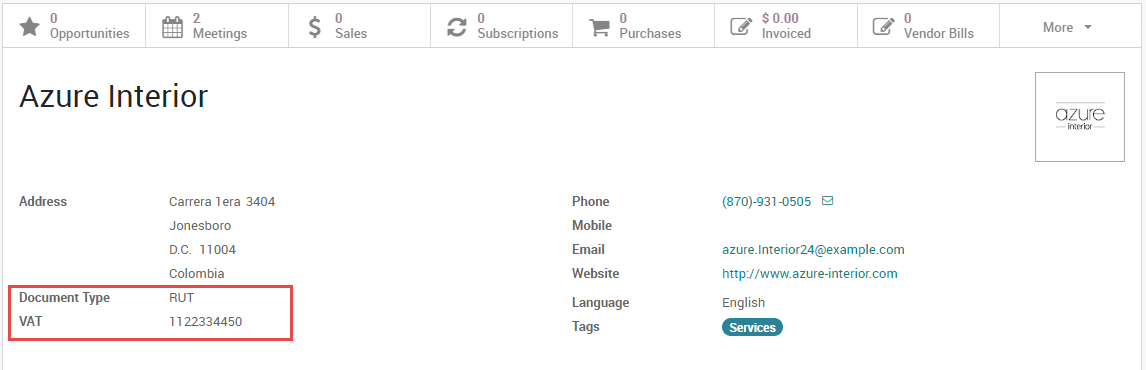

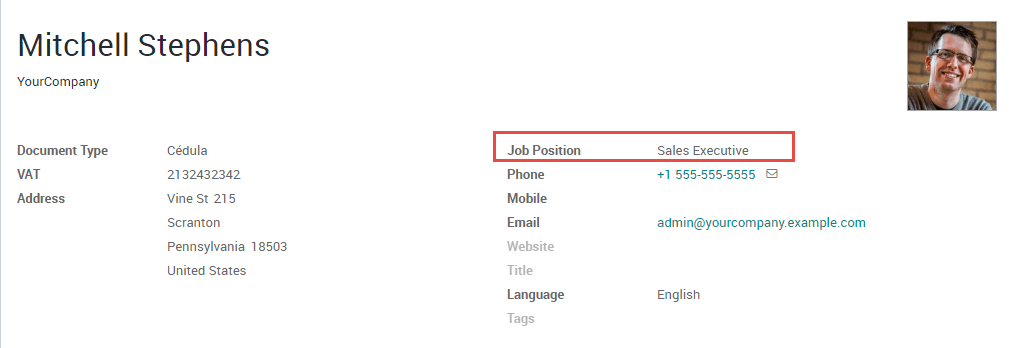

Therefore, they should be registered and should have designated an authorized signatory. The valueadded tax (VAT) is the main indirect tax This rose to 19 percent in 17;. Número de Identificación Tributaria assigned by the DIAN (Dirección de Impuestos y Aduanas Nacionales de Colombia) when the entity is registered in the RUT (Registro Único Tributario) It consists of 10 digits where the last one is a check digit in the format "" eg VAT numbers, national IDs, or general tax numbers.

Therefore, they should be registered and should have designated an authorized signatory. Up to the end of 16 the tax was 16 percent of the price of merchandise, goods and services with. Colombia has so far been less affected by the disease than its neighbors, with 60,000 confirmed infections, compared to 225,000 in Chile, 244,000 in Peru and 978,000 in Brazil For more articles.

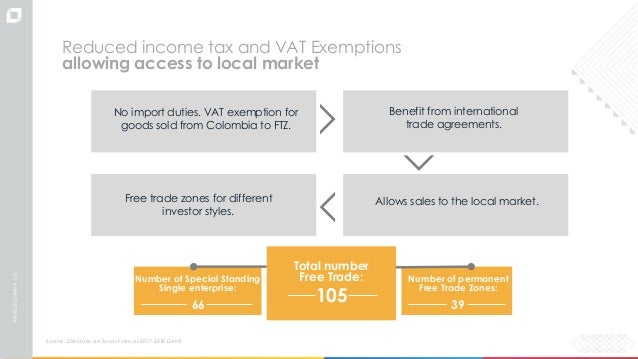

Standard custom duties for import consist of 19% VAT (however, certain services and goods are taxed only 5% and 0%) and tariffs consist of three levels 0% to 5% on capital goods, industrial goods, and raw materials not produced in Colombia, 10% on manufactured goods, and 15% to % on consumer and sensitive goods. El pasado 4 de marzo de , la Corte Suprema de Justicia emitió una sentencia que permite a la Fiscalía, y de paso los abogados, acceder a los datos bancarios de cualquier ciudadano sin previa.

Colombia S Iva Tax How Tourists Can Get An Iva Tax Refund

Colombia S Iva Tax How Tourists Can Get An Iva Tax Refund

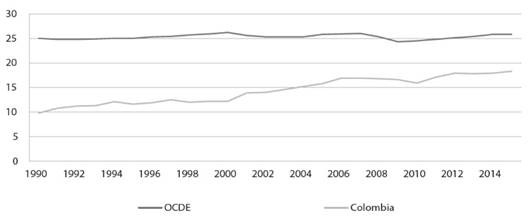

El Iva A Traves Del Tiempo En Colombia

Www Dian Gov Co Tramitesservicios Tramites Impuestos Documents Instructivo Iva En El Exterior Vr English Pdf

How To Get Your Vat Value Added Tax Refund In Ecuador For Foreign Tourists Josephle Com

Vat Reporting Analysis Software Making Tax Digital Mtd Sovos

Q Tbn And9gcrpmdbf9wdq0okpfz12uzyz Mpcvhi9xggqe6qj3a6vyvsk8gk6 Usqp Cau

Bulgaria Cuts Vat Rate To 9 On Books And Restaurant Services

Colombia S Iva Tax How Tourists Can Get An Iva Tax Refund

European Vat Number Prestashop Addons

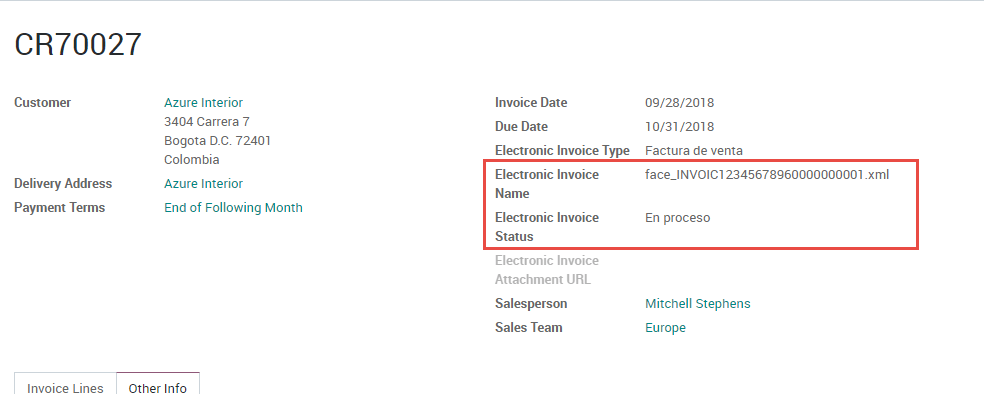

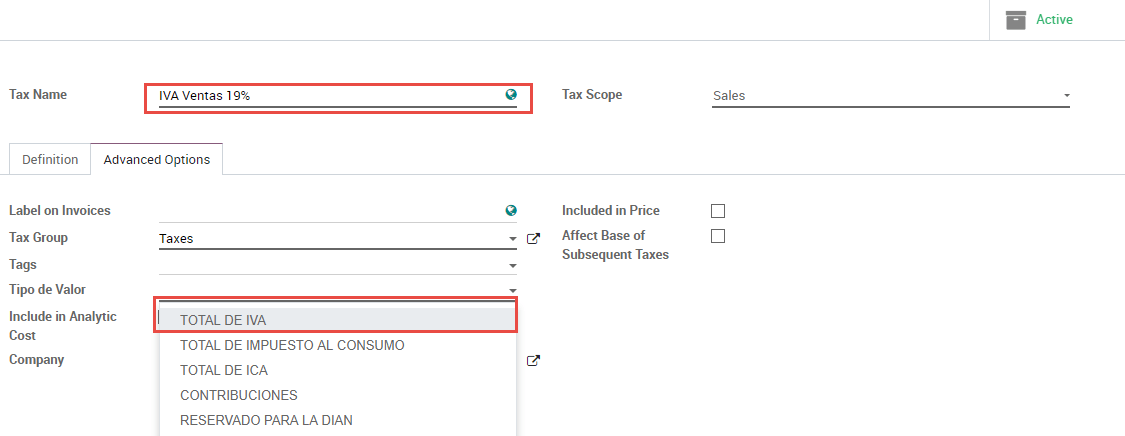

Colombia Odoo 14 0 Documentation

Hotel Madisson Inn Cartagena Cartagena Colombia Cartagena Colombia Hotelopia

How To Get A Refund On Your 16 Colombian Iva Value Added Tax Josephle Com

Business Procedures In Rwanda

Colombia S Iva Tax How Tourists Can Get An Iva Tax Refund

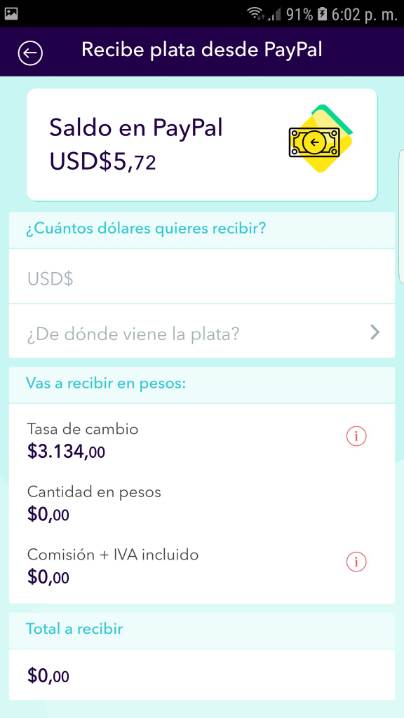

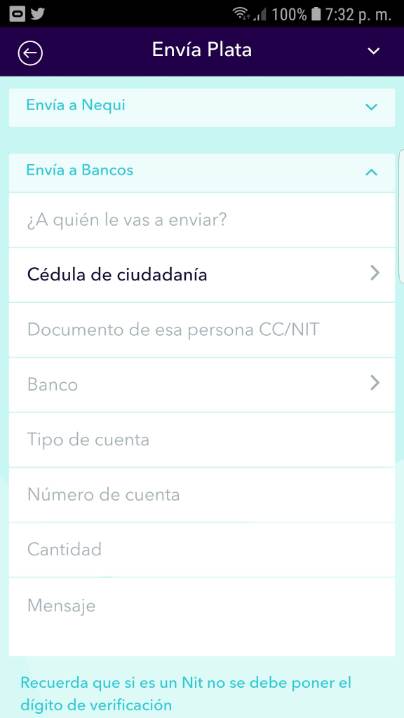

How To Withdraw Money From Paypal To A Bank Account In Colombia Using Nequi Our Code World

Colombia Presentation For 19

Vat Reporting Analysis Software Making Tax Digital Mtd Sovos

Senegal Vat Changes 18 Wts Global

Vat Registration In Portugal

Www Pwc Com Gx En Tax Pdf A Guide To Vat Gst Sut In The Americas Pdf

How To Withdraw Money From Paypal To A Bank Account In Colombia Using Nequi Our Code World

Colombia Presentation For 19

What Is Vat Rsm Kuwait

Colombians In The Usa How To Feel At Home

European Vat Number Prestashop Addons

Vat Warehouse Spain Dda Tiba

Www Pwc Com Co En Publications Doing business english version Pdf

Voec Vat On E Commerce In Norway Ecovis Explains

Numero Vat Que Es Y Como Se Tramita Holded

Http 192 167 108 132 Img Vat By Countries Pdf

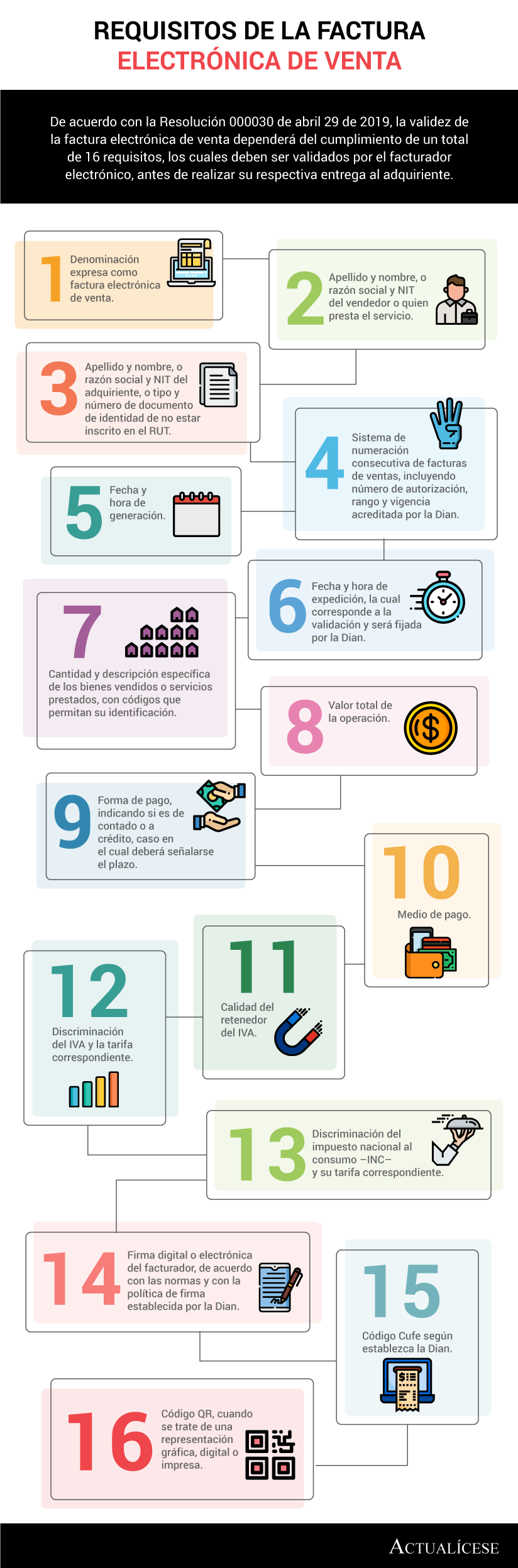

Electronic Invoice Draft Resolution Would Modify Calendar For Its Implementation

Que Es El Vat Y Como Tramitarlo Circulantis

Solidarity Income Dnp Gov Co Consult Incomesolidario Social Prosperity Return Vat Deduction Fifth Round Today September Daviplata Banco Agrario

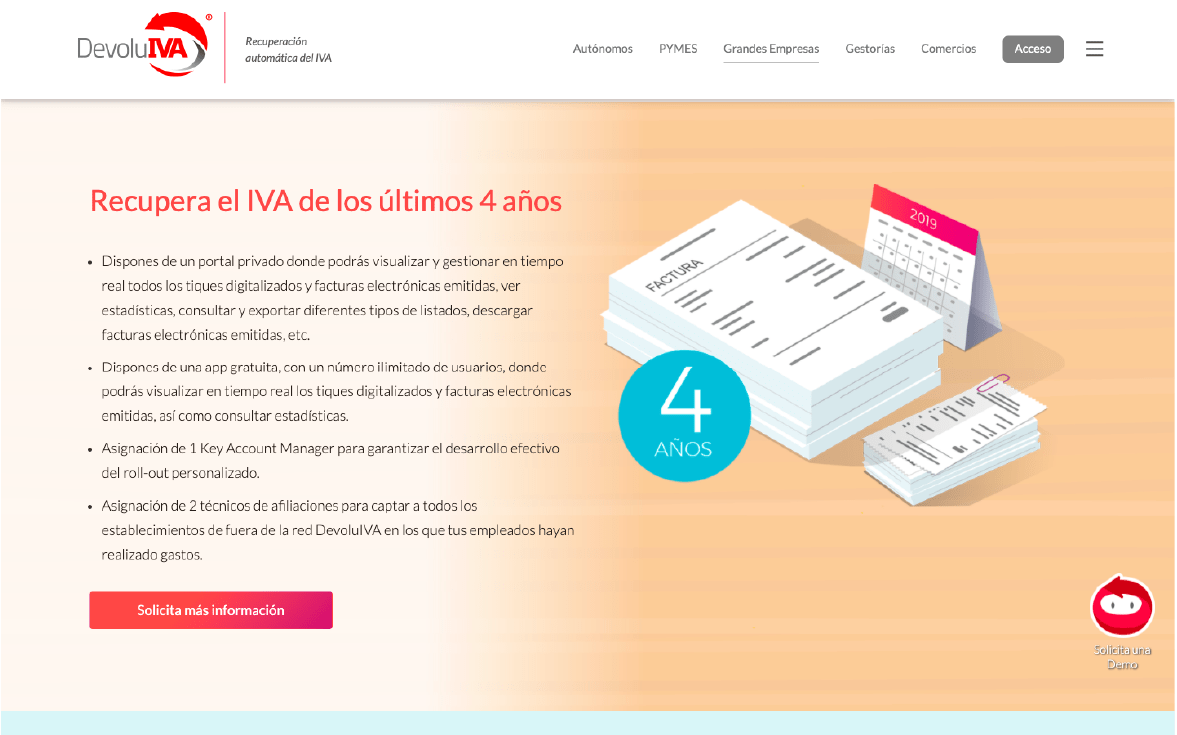

Devoluiva Vat Refund Invoice

Colombia Odoo 14 0 Documentation

How Import Taxes Work Vat Duties And Customs Clearance Vatglobal

The 16 Tax Reform In Colombia A Patchwork Quilt

Starting A Business In Colombia And Getting The Investment Visa A Step By Step Guide

Colombian Vat Guide Avalara

European Vat Number

The 16 Tax Reform In Colombia A Patchwork Quilt

Canada To Tax Digital Services Provided By Foreign Companies

Colombia S Iva Tax How Tourists Can Get An Iva Tax Refund

Vre

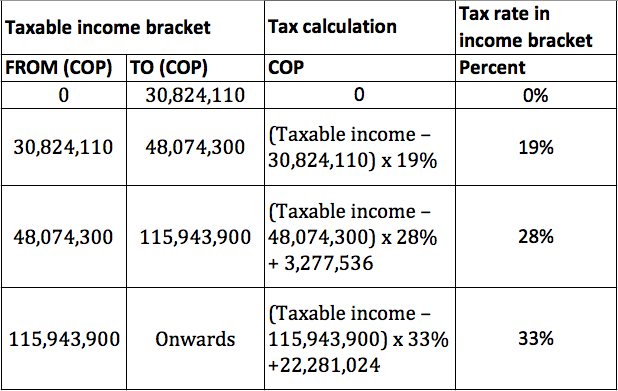

Oecd Tax Database Oecd

2

Www Dian Gov Co Tramitesservicios Tramites Impuestos Documents Instructivo Iva En El Exterior Vr English Pdf

Colombia Presentation For 19

:quality(85)//cloudfront-us-east-1.images.arcpublishing.com/infobae/QVR4MMYGAJDZ5NOFC36BRDZTDM.jpg)

Arranco El Dia Sin Iva Que Comprar Y Que No Durante La Jornada Infobae

Www Amgen Com Media Themes Corporateaffairs Amgen Com Amgen Com Downloads Invoicesubmittaladdresslist Pdf

Covid 19 Pandemic In Colombia Wikipedia

All For One Steeb Vat Number Validation Erp For Small And Midsize Enterprises

Q Tbn And9gcsjwrhyeelvs5xulecb2lbjxqaj Heb7citauylxyjyxyyuuzva Usqp Cau

Hotel In Cartagena Ibis Cartagena Marbella All

Devolucion Iva Tax Refunds For Foreigners In Colombia

The 16 Tax Reform In Colombia A Patchwork Quilt

Colombia Presentation For 19

Internacional Ecovis Barcelona

Tax Information Help Apple Search Ads Basic

Www Pwc Com Co En Publications Doing business english version Pdf

Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Azerbaijan Tin Pdf

Home All Vat Services

Www Pwc Com Gx En Tax Indirect Taxes Assets Guide To Vat Gst Sut In The Americas 18 Indirect Tax Guidance Of 21 Countries In The Americas Pdf

Vre

Colombia S Iva Tax How Tourists Can Get An Iva Tax Refund

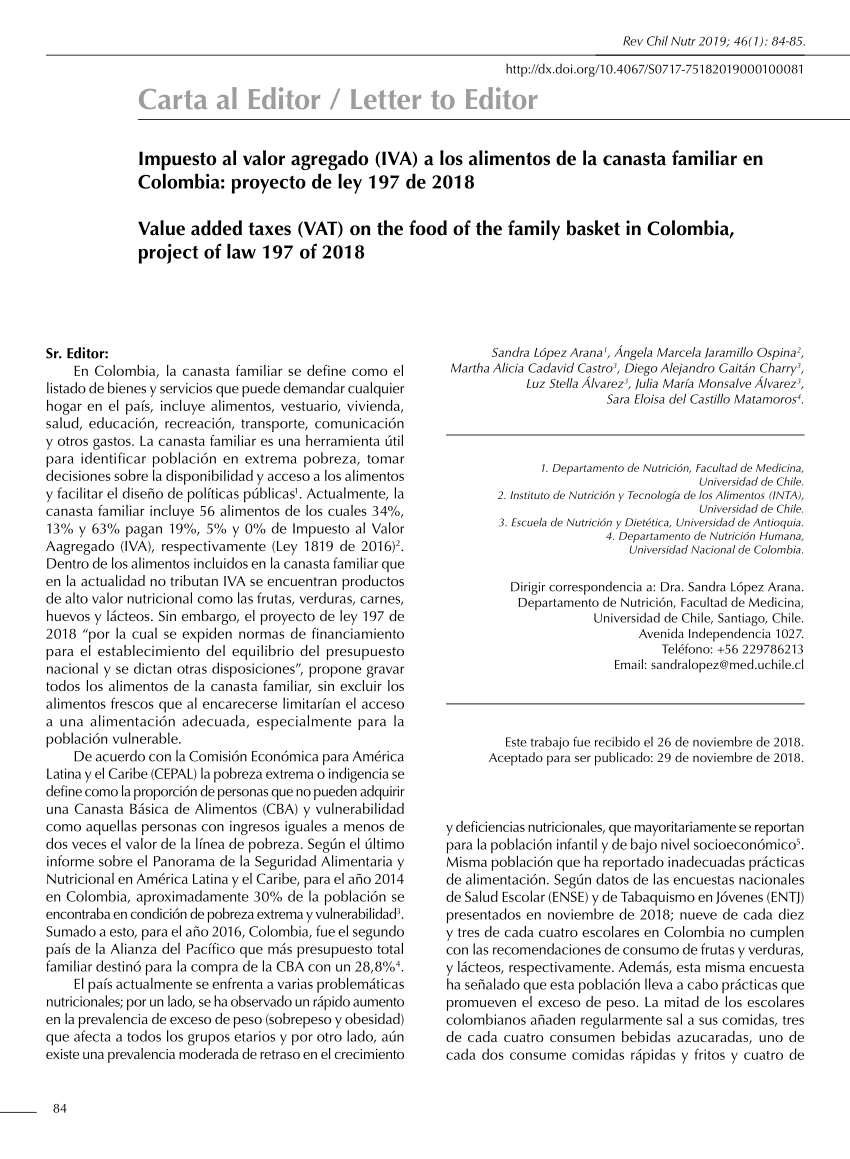

Pdf Impuesto Al Valor Agregado Iva A Los Alimentos De La Canasta Familiar En Colombia Proyecto De Ley 197 De 18

Vat In Portugal Portugese Vat Rates Number Registration Vatglobal

Dialnet Unirioja Es Descarga Articulo Pdf

In Portugal Buying Selling Cryptocurrency Is Tax Free Vatglobal

Devoluiva Vat Refund Invoice

How To Withdraw Money From Paypal To A Bank Account In Colombia Using Nequi Our Code World

Q Tbn And9gcqxue2akr4gudopyrdosmfbtk2 Uuherdhmonxfz8o97zbp 3wt Usqp Cau

How To Get A Eu Vat Number Vat Registration Quaderno

Www Dian Gov Co Tramitesservicios Tramites Impuestos Documents Instructivo Iva En El Exterior Vr English Pdf

Www2 Deloitte Com Content Dam Deloitte Es Documents Fiscal Deloitte Es Fiscal Boletiniva 1904 Pdf

Colombia Odoo 14 0 Documentation

The 16 Tax Reform In Colombia A Patchwork Quilt

The 16 Tax Reform In Colombia A Patchwork Quilt

Colombia Presentation For 19

Colombians In The Usa How To Feel At Home

Colombia Presentation For 19

Colombia Locations Baker Mckenzie

All For One Steeb Vat Number Validation Erp For Small And Midsize Enterprises

Www Dian Gov Co Tramitesservicios Tramites Impuestos Documents Instructivo Iva En El Exterior Vr English Pdf

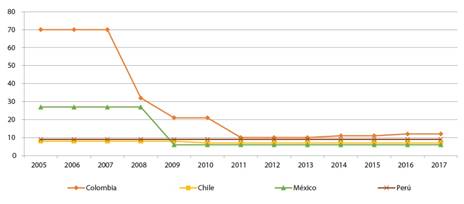

Pdf Comportamiento Del Iva En El Transporte Aereo De Pasajeros Colombia Peru Periodo 02 17 Vat Behavior Air Transport Of Passengers Colombia Peru Period 02 17 Contenido

National Identification Number Wikipedia

Pdf The Impact Of Research And Development Tax Incentives On Colombia S Manufacturing Sector What Difference Do They Make

Filing Colombia Income Taxes 16 Update

Oecd Tax Database Oecd

Vre

F3b0q743yup Bm

Www Ciat Org Biblioteca Seminariosytalleres 12 Workshoponexchangeofinformation Eoi 16 17 Socoroo Velazquez Ciat The Use Of Tins Reply To Eoi Requests Pdf

What Is Vat Rsm Kuwait

Paginas Prestadores De Servicios Desde El Exterior

Colombia Indirect Tax Guide Kpmg Global

Colombia Odoo 14 0 Documentation