Buy Limit And Buy Stop Meaning

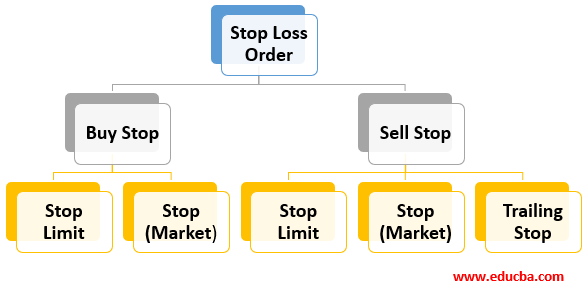

Types Of Orders Limit Condition Price Below The Limit The Limit Limit Buy Orderstop Buy Order Buy Stop Loss Order Limit Sell Order Sel What Is Stop Loss Meaning And Strategy Meaning Meme On

Forex Stop Order Definition Forex Diamond Ea Myfxbook

Limit Order Vs Stop Order Difference And Comparison Diffen

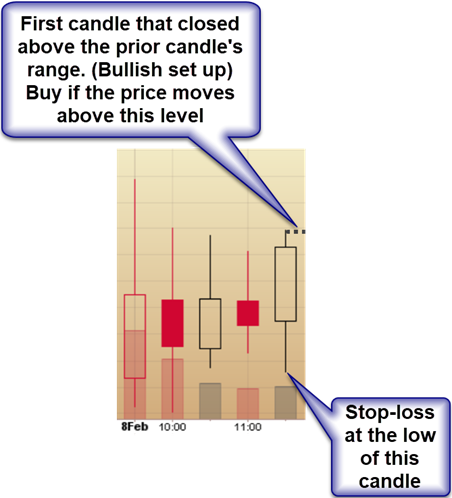

Candlestick Patterns Types Of Candlestick Patterns 5paisa 5pschool

What Is The Difference Between Stop Loss Sl And Sell Limit Sl Tani Forex Basics Tutorial Youtube

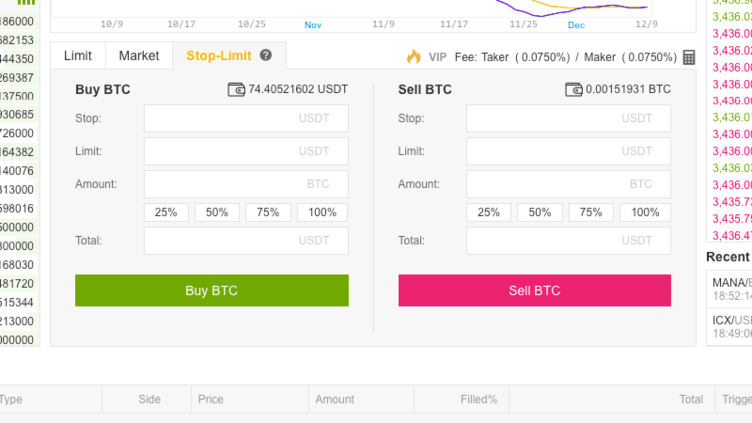

Types Of Order Binance Support

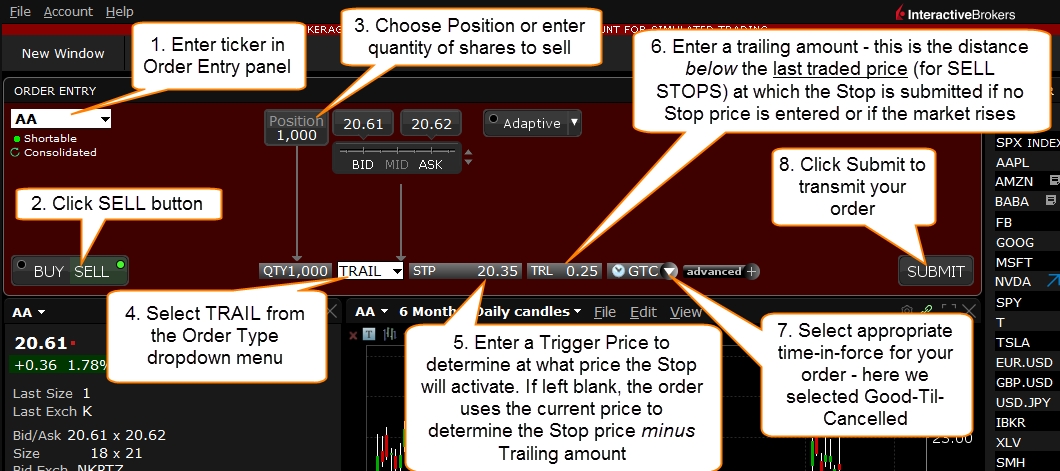

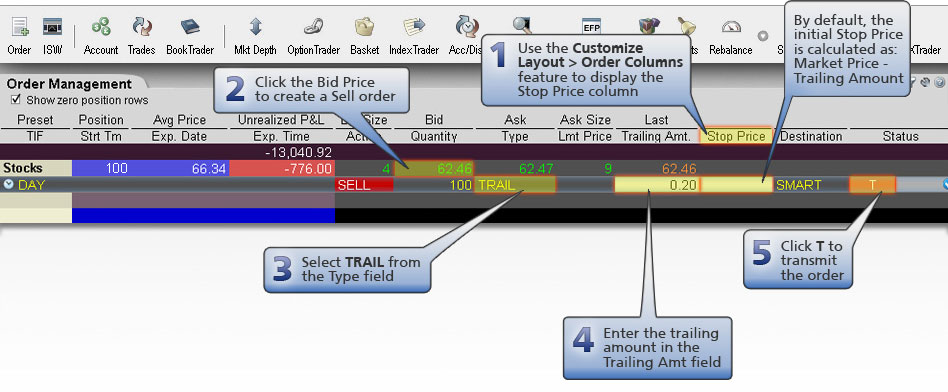

Let’s say my limit order from the prior example to buy MSFT was filled, and although I expect the stock to go up, I want to limit my losses in case it drops by, say 5% or more I can place the below trailing stop order with a % stop value of 5%, which will automatically sell my share at the market price if and when (and only if and when) the.

Buy limit and buy stop meaning. If the limit order to buy at $133 was set as ‘Good ‘til Canceled,’ rather than ‘Day Only,’ it would still be in effect the following trading day If the stock were to open at $130, the buy limit order would be triggered and the purchase price expected to be around $130—a more favorable price to the buyer. A condition on a Good 'til Canceled Limit order to buy or a stop order to sell a security This condition prevents the order limit or stop price from being reduced by the amount of the dividend when a stock goes exdividend or the stock's price is reduced due to a split All or None/Do Not Reduce. Once the stop price is reached, the stoplimit order becomes a limit order to buy or sell at the limit price or better" Investopedia If the stoplimit order simply becomes a limit order at the stop price, what is the point of making a stoplimit order if you can simply make a limit order?.

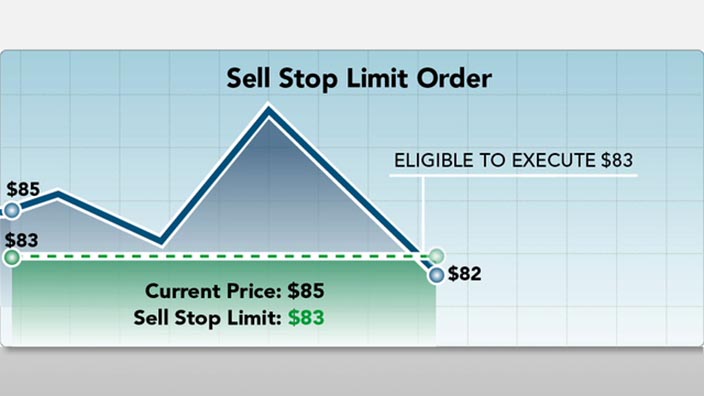

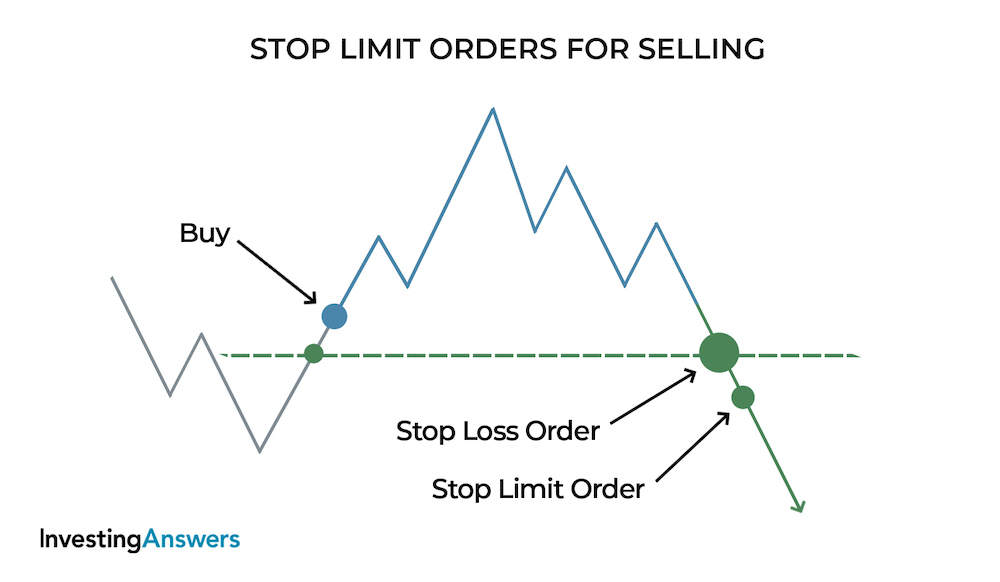

A stop limit order is a combination of a stop order and a limit order With a stop limit order, after a certain stop price is reached, the order turns into a limit order, and an asset is bought or sold at a certain price or better These orders are similar to stop limit on quote and stop on quote orders. A limit order is visible to the market and instructs your broker to fill your buy or sell order at a specific price or better A stop order isn't visible to the market and will activate a market. Using Buy Limit and Buy Stop Orders Buy Limit A buy limit is an order to buy at a level below the current price If price was to move lower and into your chosen price, your entry would be activated at the best available price An example of this may be;.

Limit orders are not absolute orders Your limit order to buy XYZ at $3345 per share won't be filled above that price, but it can be filled below that price—and that's good for you If the stock's price falls below your set limit before the order's filled, you could benefit and pay less than $3345 per share. 🔔NEW STOCK TRADING CHANNEL🔔 https//wwwyoutubecom/channel/UCDVgFZJA_pRkPur21jUhRBA?sub_confirmation=1 ⛔Free Stock Trading Guide⛔ https//wwwmarketmovesmat. Limit orders have a buy and sell component (Buy Limit and Sell Limit) A Buy Limit is used when the trader feels that the price of the asset will fall initially before they start to rise again.

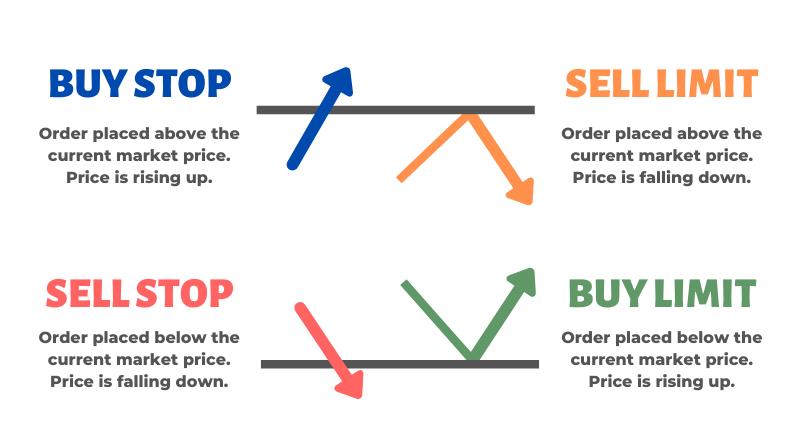

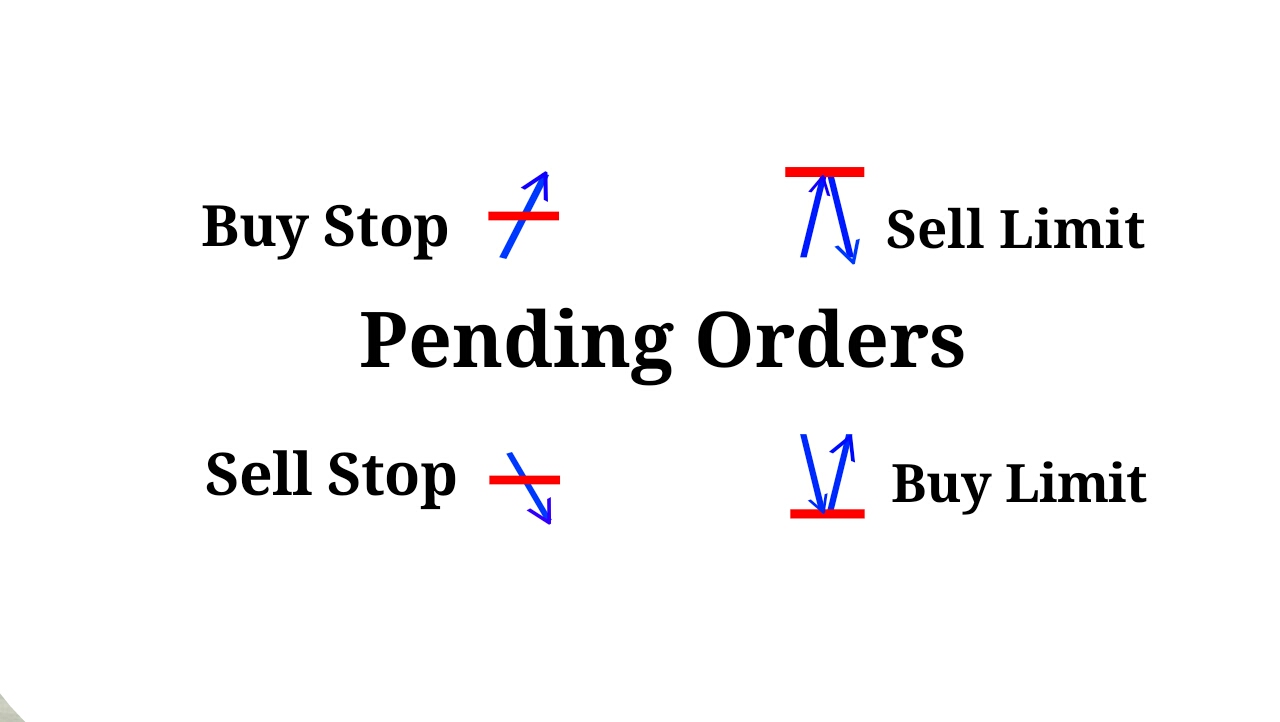

The market might be at and you want a Buy trade to be placed at 110 A Buy Stop means a Buy trade will be placed at a price ABOVE the current market price Buy Limit This is basically the same thing as a Buy Stop, except that you are confident that the market will REVERSE if it gets down to a certain price The market might be at and you want your broker to place a trade if the market drops to A Buy Limit means a Buy trade will be placed at a price BELOW the current. Stop orders allow customers to buy or sell when the price reaches a specified value, known as the stop price This order type helps traders protect profits, limit losses, and initiate new positions To place a stop limit order Select the STOP tab on the Orders Form section of the Trade View;. With a buy stop limit order, the limit order portion must be higher than the trigger portion of the order That said, you could have put a limit order at $115 You can see how much easier it becomes when you learn order types.

Both definitions appear to be the same thing to me. A buy limit is used to buy below the current price while a buy stop is used to buy above the current price They are pending orders for a buy in Forex Trading (and other financial trades) if you don’t want to buy at the current market price or you want to buy when the price changes to a certain direction. A limit order places an order on the order book in hopes that it’ll be filled by someone else’s market order A sell limit order is called an “ask” and a buy limit order is called a “bid” Limit order will “fill” as market orders buy or sell into limit orders The “last” order filled is the market price.

Learn how Stop Market, Stop Limit, and Trailing Stop orders can help protect your investments or cap lossesOpen an account https//gotdcom/2mEv4ujLearnin. The market might be at and you want a Buy trade to be placed at 110 A Buy Stop means a Buy trade will be placed at a price ABOVE the current market price Buy Limit This is basically the same thing as a Buy Stop, except that you are confident that the market will REVERSE if it gets down to a certain price The market might be at and you want your broker to place a trade if the market drops to A Buy Limit means a Buy trade will be placed at a price BELOW the current. A limit order will set the maximum or minimum at which the trader is willing the buy or sell the particular stock or.

The stoplimit order triggers a limit order when a stock price hits the stop level For example, you might place a stoplimit order to buy 1,000 shares of XYZ, up to $950, when the price hits $9 In this example, $9 is the stop level, which triggers a limit order of $950 Combining the two, we have the stoplimit order Stoplimit orders can be super helpful for trading if you can’t watch your trades all day And they can be especially useful for stocks with thin trading volume, such as. When you place a buy stop limit order when purchasing XYZ stock at $28, the order will only become active if the price moves higher than $28 If it becomes active, the order will only be executed at $28 or better Assuming you want to sell the XYZ stock if it trades to $19 At the moment, it is currently trading at $23. A buy limit is used to buy below the current price while a buy stop is used to buy above the current price They are pending orders for a buy in Forex Trading (and other financial trades) if you don’t want to buy at the current market price or you want to buy when the price changes to a certain direction.

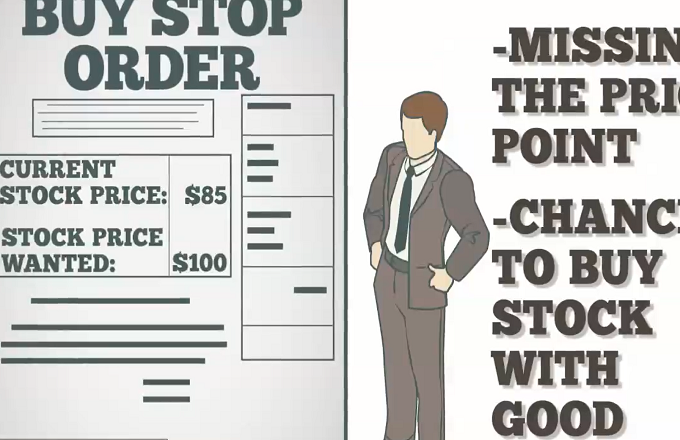

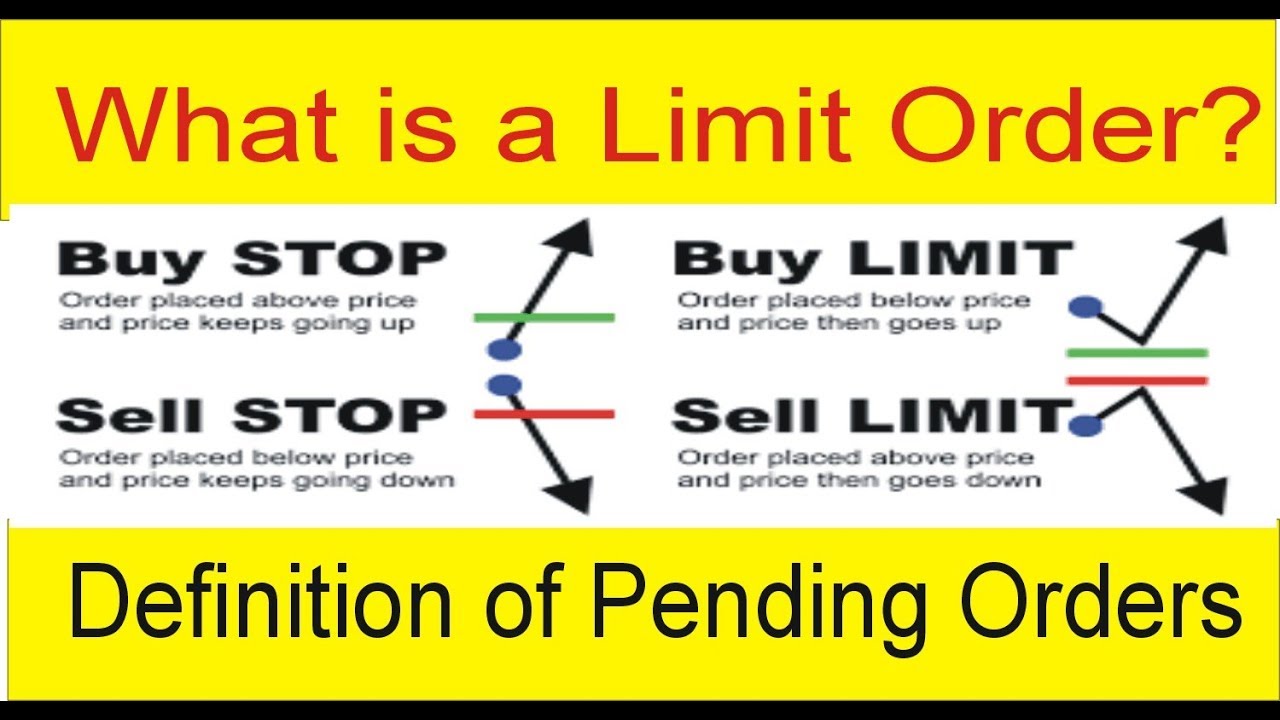

You are looking to buy the ABC / XYZ pair, but only at a lower price. Using Buy Limit and Buy Stop Orders Buy Limit A buy limit is an order to buy at a level below the current price If price was to move lower and into your chosen price, your entry would be activated at the best available price An example of this may be;. A buy stop order is placed above the current market price, and a sell stop order is placed below the current price (to protect a profit or limit a potential loss) For listed securities, a stop order to buy becomes a market order when a trade occurs at or above the stop price.

Buy Stop Limit – this type combines the two first types being a stop order for placing Buy Limit As soon as the future Ask price reaches the stoplevel indicated in the order (the Price field), a Buy Limit order will be placed at the level, specified in Stop Limit price field A stop level is set above the current Ask price, while Stop Limit. A StopLimit order will be executed at a specified price (or better) after a given stop price has been reached Once the stop price is reached, the StopLimit order becomes a limit order to Buy (or Sell) at the limit price or better We're sorry this didn't help. A stoplimit order, true to the name, is a combination of stop orders (where shares are bought or sold only after they reach a certain price) and limit orders (where traders have a maximum price.

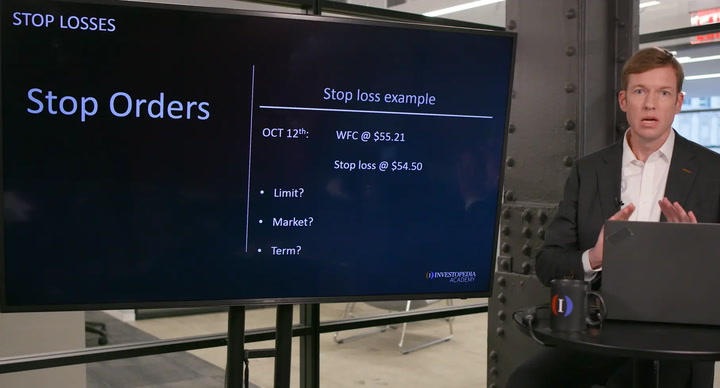

When using a stoplimit order, the stop and limit prices of the order can be different For example, a trader placing a stoplimit sell order can set the stop price at $50 and the limit price at $4950 In this scenario, the stoplimit sell order would automatically become a limit order once the stock dropped to $50, but the trader's shares won. Limit = Reverse, meaning buy limit is I want the price to go down, hit my order and “reverse” back up, therefore my buy order has to be below current market price Same for sell pending orders Stop = Through, meaning buy stop is I want the price to go up, hit my order and keep going up ie, go “through” my order, therefore my buy order has to be above the current market price. A stop order, also referred to as a stoploss order is an order to buy or sell a stock once the price of the stock reaches the specified price, known as the stop price When the stop price is reached, a stop order becomes a market order A buy stop order is entered at a stop price above the current market price Investors generally use a buy stop order to limit a loss or protect a profit on a stock that they have sold short.

The stoplimit order triggers a limit order when a stock price hits the stop level For example, you might place a stoplimit order to buy 1,000 shares of XYZ, up to $950, when the price hits $9 In this example, $9 is the stop level, which triggers a limit order of $950 Combining the two, we have the stoplimit order Stoplimit orders can. A buy stoplimit order involves two prices the stop price, which activates the limit order to buy, and the limit price, which specifies the highest price you are willing to pay for each share By placing a buy stoplimit order, you are telling the market maker to buy shares if the trade price reaches or exceeds your stop price¬—but only if you can pay a certain dollar amount or less per share. When you place a limit order to buy a stock, picture yourself at an openair market bartering for something that has caught your eye.

A market order executes a buy or sell of a security at the next available price Market orders guarantees an execution, but does not guarantee a price of a security A limit order allows you to set a specific price to execute an order on a security and guarantees that price. A buy limit order lets investors buy shares at or below a specified price That allows them to keep control over how much they pay Investors give the order to a broker, who will only fill it if the share falls to the set price or below during the time the order is in place. Have questions, please comment on this video and we will answer them!Join BK Forex Academy https//bitly/2HY2qeN Daily Coaching, Tips, & Trade Ideas Bria.

In a stop order, that would mean that once the shares hit $30 your order is triggered and turned into a market order But with a stoplimit order, you can also put a limit price on it. Stop orders and limit orders are very similar Both place an order to trade stock if it reaches a certain price But a stop order, otherwise known as a stoploss order, triggers at the stop price or worse A buy stop order stops at the given price or higher A sell stop order hits given price or lower. If the limit order to buy at $133 was set as ‘Good ‘til Canceled,’ rather than ‘Day Only,’ it would still be in effect the following trading day If the stock were to open at $130, the buy limit order would be triggered and the purchase price expected to be around $130—a more favorable price to the buyer.

Buy Stop Limit Order is the best order I know that but in my Trading School they also learned me one thing about this Buy STLO that you will be protected against gap if the order gap up and you Bought STLO then you are in position why I say so because when I simulated the Stock TradingSim my order are canceled with Buy Stop Limit Order. A buy stoplimit order involves two prices the stop price, which activates the limit order to buy, and the limit price, which specifies the highest price you are willing to pay for each share By placing a buy stoplimit order, you are telling the market maker to buy shares if the trade price reaches or exceeds your stop price¬—but only if you can pay a certain dollar amount or less per share. Stop Limit Order Law and Legal Definition Stop Limit Order is a stop order that becomes a limit order after the specified stop price has been reached Stop Order is an order to buy securities at a price above or sell at a price below the current market The primary benefit of a stoplimit order is that the trader has precise control over when the order should be filled.

A buy stop order stops at the given price or higher A sell stop order hits given price or lower A limit order captures gains A stop order minimizes loss Your Widget Co investment at $10 per share looks good, but might decline Setting a stop order for $8 per share would sell shares of Widget Co as soon as they dip to $8 or lower. In order to catch the move while you are away, you set a sell limit at 100 and at the same time, place a related buy limit at , and just in case, place a stoploss at As an OTO, both the buy limit and the stoploss orders will only be placed if your initial sell order at 100 gets triggered. A buy limit order is a limit order to buy at a specified price A sell stop order is a stop order to sell at a market price after a stop price parameter has been reached Buy Limit Order.

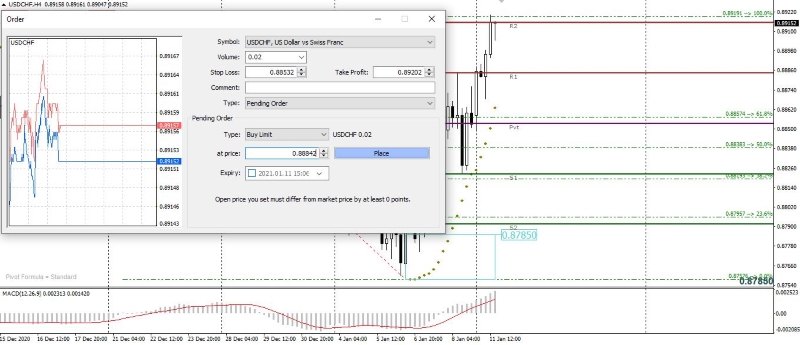

How to place trades in MT4 using Buy Stop, Sell Stop, Buy Limit or Sell Limit. Buy Stop Limit – this type combines the two first types being a stop order for placing Buy Limit As soon as the future Ask price reaches the stoplevel indicated in the order (the Price field), a Buy Limit order will be placed at the level, specified in Stop Limit price field A stop level is set above the current Ask price, while Stop Limit. Buy Stop Limit Order is the best order I know that but in my Trading School they also learned me one thing about this Buy STLO that you will be protected against gap if the order gap up and you Bought STLO then you are in position why I say so because when I simulated the Stock TradingSim my order are canceled with Buy Stop Limit Order.

A buy stoplimit order involves two prices the stop price, which activates the limit order to buy, and the limit price, which specifies the highest price you are willing to pay for each share. Have questions, please comment on this video and we will answer them!Join BK Forex Academy https//bitly/2HY2qeN Daily Coaching, Tips, & Trade Ideas Bria. It instructs the broker to execute a trade when a stock reaches a price beyond which the investor is unwilling to sustain losses For buy orders, this means buying as soon as the price climbs above the stop price.

In addition, the stop orders are specifically helpful to investors that are unable to constantly monitor the market Moreover, some of the brokerages are offering the setup of a stop order for free What is a Limit order?. The limit order is one of the most commonly used and recommended order types when trading stocks This article will explain how it works and how to enter it in TD Ameritrade account What is a Limit Order?. StopLimit Order A stoplimit order is an order placed with a broker that combines the features of a stop order with those of a limit order A stoplimit order will be executed at a specified.

Learn everything about MT4 order types like buy stop, sell stop, sell limit, buy limit, mt4 market buy order and market sell order in this post You see, the MT4 trading platform really makes orders so easy in that there are only 2 Main Types of MT4 orders Pending orders (there are 4 types buy stop, sell stop, sell limit, buy limit). Placing a buy stoplimit order with a stop price at $ and a limit price of $22 means that if Snap hits $, the order becomes a limit order for $22 But the order will only be filled if you can buy at $22 or lower, effectively creating an even tighter range for what you would pay for Snap stock beyond just a limit or stop order alone. Choose whether you'd like to Buy or Sell.

For over the counter (OTC) securities, a stop limit order to buy becomes a limit order, and a stop loss order to buy becomes a market order, when the stock is offered (National Best Offer quotation) at or higher than the specified stop price A stop limit order to sell becomes a limit order, and a stop loss order to sell becomes a market order, when the stock is bid (National Best Bid quotation) at or lower than the specified stop price. The market might be at and you want a Buy trade to be placed at 110 A Buy Stop means a Buy trade will be placed at a price ABOVE the current market price Buy Limit This is basically the same thing as a Buy Stop, except that you are confident that the market will REVERSE if it gets down to a certain price The market might be at and you want your broker to place a trade if the market drops to A Buy Limit means a Buy trade will be placed at a price BELOW the current. You don't want to overpay, so you put in a stoplimit order to buy with a stop price of $27 and a limit of $2950 If the stock trades at the $27 stop price or higher, your order activates and turns into a limit order that won't be filled for more than your $2950 limit price Sell stoplimit order.

It's actually really simple A buy limit order would be an order to buy the market at a price below the current price A buy stop order would be an order to buy the market at a price above the current price It's just the inverse with sell orders A sell limit order would be an order to sell the market at a price above the current price. A Limit if Touched is an order to buy (or sell) an instrument at a specified price or better, below (or above) the market This order is held in the system until the trigger price is touched An LIT order is similar to a stop limit order, except that an LIT sell order is placed above the current market price, and a stop limit sell order is placed below. Stop Limit – This turns your trade into a Limit Order once it is triggered by the Trigger price you have selected (the order will be executed at the specified Limit price or better) For Buy Orders your Limit price is the highest price you are willing to pay once your order is triggered For Sell orders the Limit price is the lowest price you are willing to accept once your order is triggered Short Sell Stop/Stop Limit – This is to short a stock below the current market price When the.

Limit orders are used to buy and sell a stock, while stoplimit orders set two prices on the stock and one is a stop price that states what price the stock must hit for the order to become active They each have their own advantages and disadvantages, so it's important to know about each one. A buy limit is used to buy below the current price while a buy stop is used to buy above the current price They are pending orders for a buy in Forex Trading (and other financial trades) if you don’t want to buy at the current market price or you want to buy when the price changes to a certain direction In order to trade, you have to buy or sell at the current market price or use pending. For buy orders, this means buy at the limit price or lower, and for sell limit orders, it means sell at the limit price or higher A stop order, sometimes called a stoploss order, is used to limit losses;.

Stop orders allow customers to buy or sell when the price reaches a specified value, known as the stop price This order type helps traders protect profits, limit losses, and initiate new positions To place a stop limit order.

Trade Orders Definition Types Study Com

What Is A Choppy Market Or Congestion Area By Itradeprice Medium

Stop Limit Order Definition Day Trading Terminology Live Traders

3 Order Types Market Limit And Stop Orders Charles Schwab

How Does A Stop Order And A Stop Limit Order Differ

Stop And Limit Orders Howthemarketworks

What Is A Limit Order Definition Of Pending Order In Urdu Tani Forex

Trailing Stop Orders Interactive Brokers Llc

Handwriting Text Don T Limit Yourself Concept Meaning Selfcontrol Moderation Underestimate You Stop Afraid Megaphone With Sound Volume Icon And Blank Color Speech Bubble Photo Buy This Stock Illustration And Explore

Types Of Order Binance Support

/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

Credit Limits What Are They

What Are Cover Orders And How To Use Them

/blur-1853262_19201-485cc15952974d8ab3af724fc5636238.jpg)

The Difference Between A Limit Order And A Stop Order

Trading Order Types Buy Stop Sell Stop Buy Limit Sell Limit And Market Orders

Forex Ea Update Pending Orders Projectreaper Team Official Dev Blog

Etf Order Types Back To The Basics Seeking Alpha

Mt4 Trade Copier Multiterminal Power Trade Copier

Gx1rx Oxvvgslm

Buy Limit And Buy Stop Difference In Forex

Stop Limit Order Definition Day Trading Terminology Live Traders

.png)

How To Trade Bitcoin Learn About Bitcoin Trading

What Is Buy Limit Sell Limit Buy Stop Sell Stop How To Use It To Mt4 Pending Orders Youtube

Stop Loss Order A Quick Glance Of Stop Loss Order

Explaining The Trailing Stop Limit And A Better Alternative

Stop Loss Meaning Stop Limit Market Price And Order Types In Cryptocurrency Jotscroll

Limit Order Definition Bramesh S Technical Analysis

Trailing Stop Loss Vs Trailing Stop Limit Which Should You Use

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape

Buy Limit Fx How Limit Fx Orders Work And How To Buy

Types Of Forex Orders Babypips Com

Types Of Orders Limit Condition Price Below The Limit The Limit Limit Buy Orderstop Buy Order Buy Stop Loss Order Limit Sell Order Sel What Is Stop Loss Meaning And Strategy Meaning Meme On

Stop Your Phone From Using So Much Data The New York Times

Truths About Stop Losses That Nobody Wants To Believe

How To Types Forex Market Order Buy Limit Sell Limit Buy Stop Sell Stop Stop Loss Easy To Learn Youtube

Buy Limit And Buy Stop Difference In Forex

Buy Stop Order Definition

Buy Limit Order Definition Examples How Does It Work

Types Of Forex Orders And Stop Loss Definition

Types Of Forex Orders Babypips Com

Buy Stop And Buy Limit Sell Stop And Sell Limit Pending Orders On Metatrader 4

Trading Up Close Stop And Stop Limit Orders Youtube

What Is A Stop Limit Order Fidelity

Forex Trading Large Candles Buy Limit Hormitec Cl

.png)

How To Trade Bitcoin Learn About Bitcoin Trading

/teslabuystopordersonmoveaboveresistance-39993ae867c34d16b9c7821f252d6f1f.jpg)

Buy Stops Above Definition And Example

What Is Buy Sell Stop And Limit Explained Order Types In Forex Trading

Types Of Forex Orders Babypips Com

Forex Stop Order Definition Forex Diamond Ea Myfxbook

:max_bytes(150000):strip_icc()/atrexample2-5a1dc3cfb39d030039c291bc.jpg)

How Average True Range Atr Can Improve Your Trading

Buy Limit Order Definition And Example

3 Order Types Market Limit And Stop Orders Charles Schwab

How To Place A Stop Limit Order W Td Ameritrade App 2 Min Youtube

What Is Buy Sell Stop And Limit Explained Order Types In Forex Trading

Buy Stop Vs Buy Limit

Types Of Forex Orders Profitf Website For Forex Binary Options Traders Helpful Reviews Forex Forex Signals Order

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1167016717-0cd77ce262f74e2dbda93d1af8140b44.jpg)

What Is A Stop Market

Bid Ask Spread Wikipedia

Buy Stop And Buy Limit Sell Stop And Sell Limit Pending Orders On Metatrader 4

Buy Stop And Buy Limit Sell Stop And Sell Limit Pending Orders On Metatrader 4

Forex Forex Trading Forex Factory Forex Signals Forexlive Forex Trading App Forex Rates Forex Calendar Forex Tradi Trade Finance Trading Quotes Trading Charts

:max_bytes(150000):strip_icc()/trailing-stop-loss-indicator-5854379a5f9b586e02d5f6cc.jpg)

Trailing Stop Loss What Is It

Types Of Forex Orders Babypips Com

Stop Limit Order Examples Meaning Investinganswers

/RobinhoodLevel2-9fc2600afd384175b8b6a9af7e37df62.png)

Market Depth Definition

Trailing Stop Orders Interactive Brokers Llc

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape

/teslabuystopordersonmoveaboveresistance-39993ae867c34d16b9c7821f252d6f1f.jpg)

Buy Stops Above Definition And Example

Types Of Forex Orders Babypips Com

Stop Loss Order Definition Examples Calculate Stop Order To Buy Sell

鼎展金業 香港十大貴金屬交易平台 香港官網

Types Of Forex Orders Babypips Com

Forex Stop Order Definition Forex Diamond Ea Myfxbook

What Is A Stop Limit Order And When Should You Use It Thestreet

Top 3 Reasons To Use Oco Orders Phillip Cfd

How Can I Use The Gtt Feature

What Is A Stop Limit Order Binance Academy

What Is Buy Limit Sell Limit Buy Stop Sell Stop How To Use It To Mt4 Pending Orders Youtube

5 Things Not To Do In The Robinhood App For Stock Trading By Jen Quraishi Phillips Medium

Buy Limit Order Definition

What Is A Limit Order Definition Of Pending Order In Urdu And Hindi By Tani Forex Youtube

Stop Limit Order Definition

Definition And Meaning Of The Term Pending Order What Is Pending Order

What Are Stop Loss Orders And How To Use Them

Mastering The Order Types Stop Limit Orders Charles Schwab

Buy Stop Vs Buy Limit

3 Order Types Market Limit And Stop Orders Charles Schwab

Trading Order Types Buy Stop Sell Stop Buy Limit Sell Limit And Market Orders

Truths About Stop Losses That Nobody Wants To Believe

What Is Buy Sell Stop And Limit Explained Order Types In Forex Trading

What Is Buy Sell Stop And Limit Explained Order Types In Forex Trading

Market Order Vs Limit Order Top 4 Best Differences Examples

3 Order Types Market Limit And Stop Orders Charles Schwab

How To Trade With Priceaction Master Woods14 By Patthawan Moo Issuu