Buy Limit Buy Stop Difference

Buy Limit Buy Stop Archives Bullish Bears Trading Stocks Options Futures Free Stock Market Courses

Limit Order Vs Stop Order What S The Difference Video

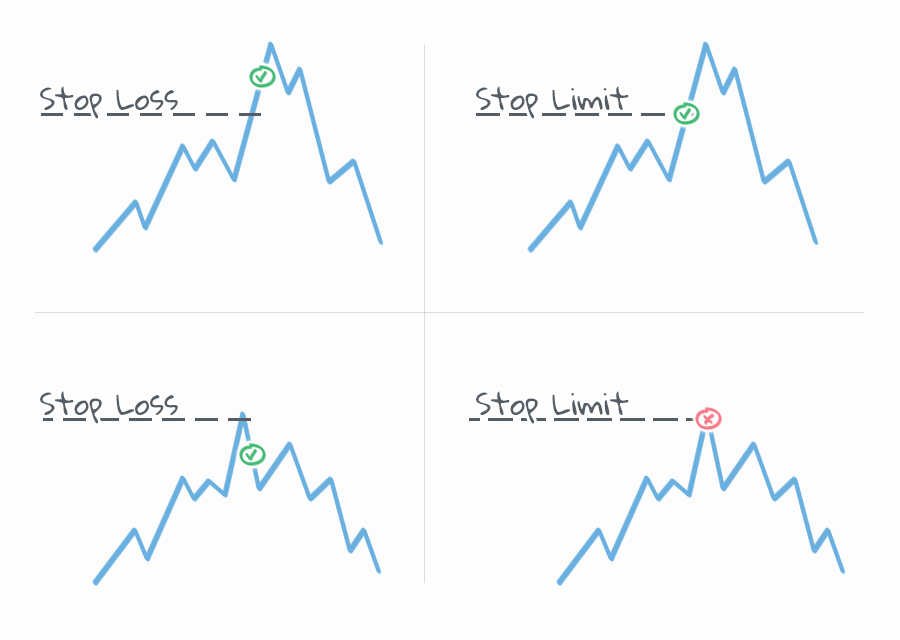

Stop Loss Vs Stop Limit Orders The Difference Explained Fxssi Forex Sentiment Board

Mastering Trading Order Types Stop Limit Limit And Stop Orders By Elena Stormgain Crypto Dec Medium

Buy Stop Limit Order Mt5 Day Trade This Etf

Mt4 Buy Limit Sell Limit Buy Stop Sell Stop In Hindi Buy Limit Sell Limit Buy Stop Sell Stop Forex Youtube

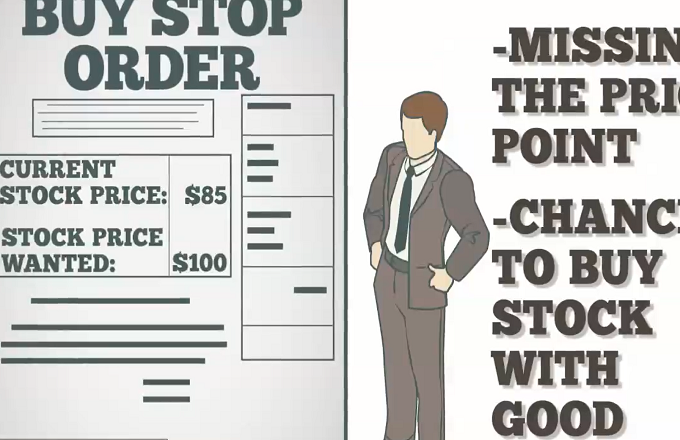

A buy stop order is triggered when the stock hits a price, but if its moving faster than expected, without a limit price you may end up paying quite a bit more than you anticipated when you first.

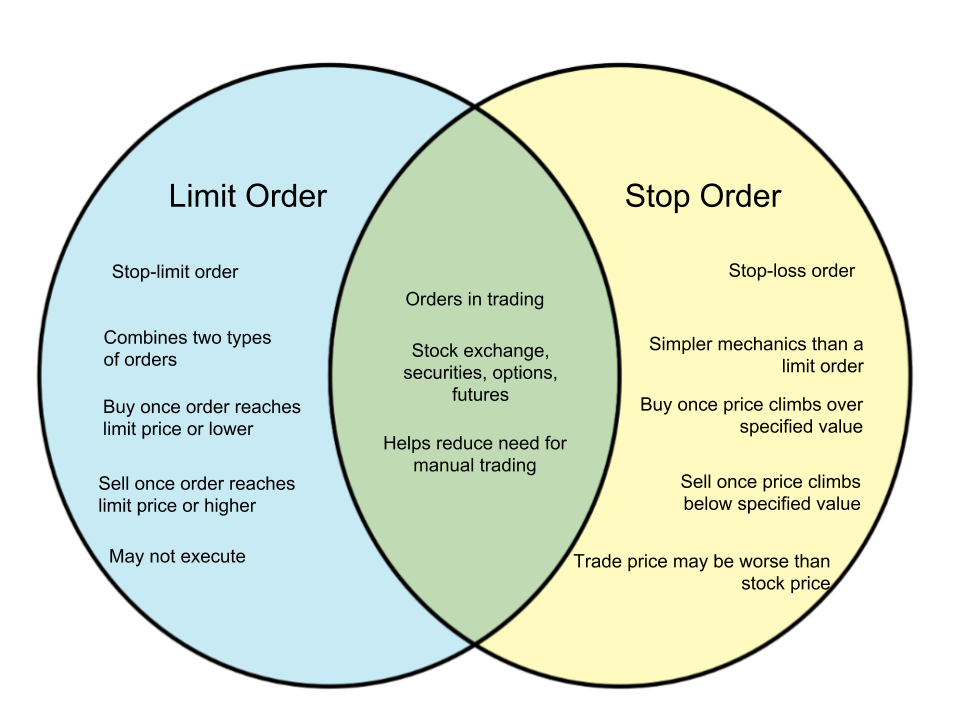

Buy limit buy stop difference. A Stop order is a type of validity instruction and is similar to a Limit order where a buyer or seller sets a specific price that they want the trade to be filled at Instead of setting a maximum or minimum price which is what a limit order does, the trade will be immediately executed at the stop price;. Source StreetSmart Edge® The above chart illustrates the use of market orders versus limit orders In this example, the last trade price was roughly $139 A trader who wants to purchase (or sell) the stock as quickly as possible would place a market order, which would in most cases be executed immediately at or near the stock’s current price of $139—providing that the market was open. Stop orders wait until a particular (adverse) condition is met before turning into a limit order On the sell side If the price is currently $40 and you submit a limit order to sell at $36, it will immediately execute at $40 because this is even better than $36;.

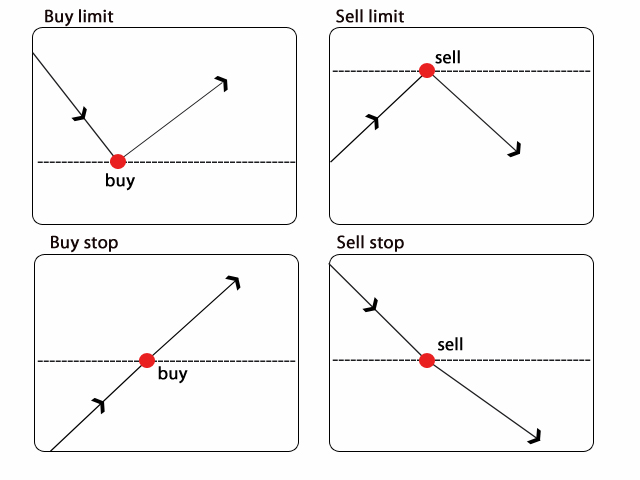

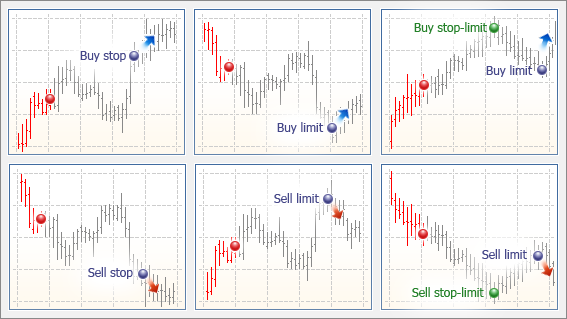

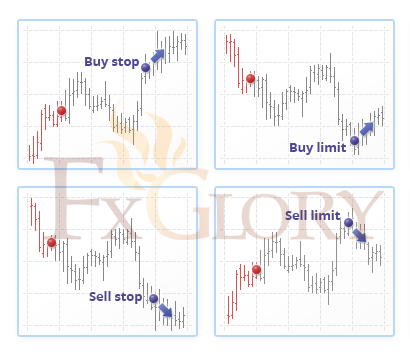

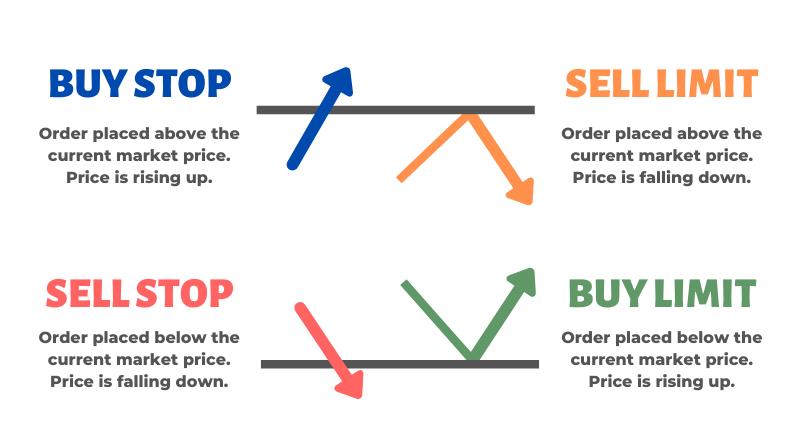

A buy stop you would use on a breakout trade whereas a buy limit you would use if you were looking for the pair to bounce off a certain level but continue going long after the retracement Dont make it harder then it has to be. Limit and stop order difference example Let’s assume that the EURUSD price is at level right now Based on your strategy, you presume to have a psychological resistance at level and the pair to have a resistance bounce backward. Buy Limit – an order to open a Buy position at a lower price than the current price level;.

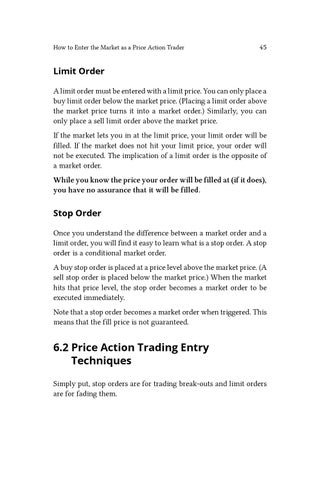

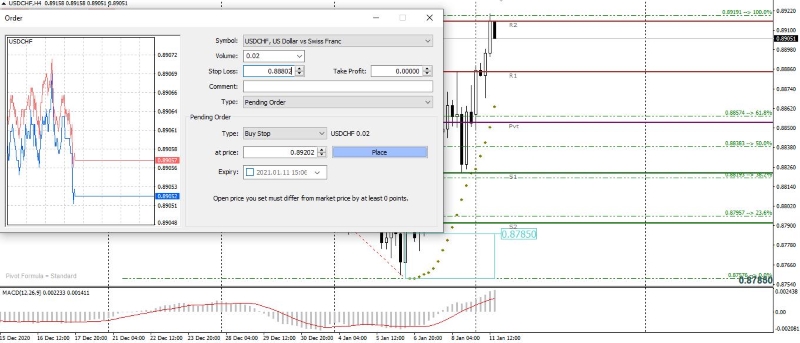

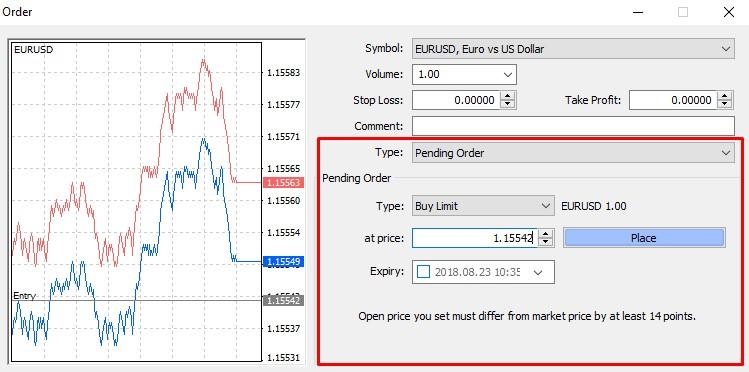

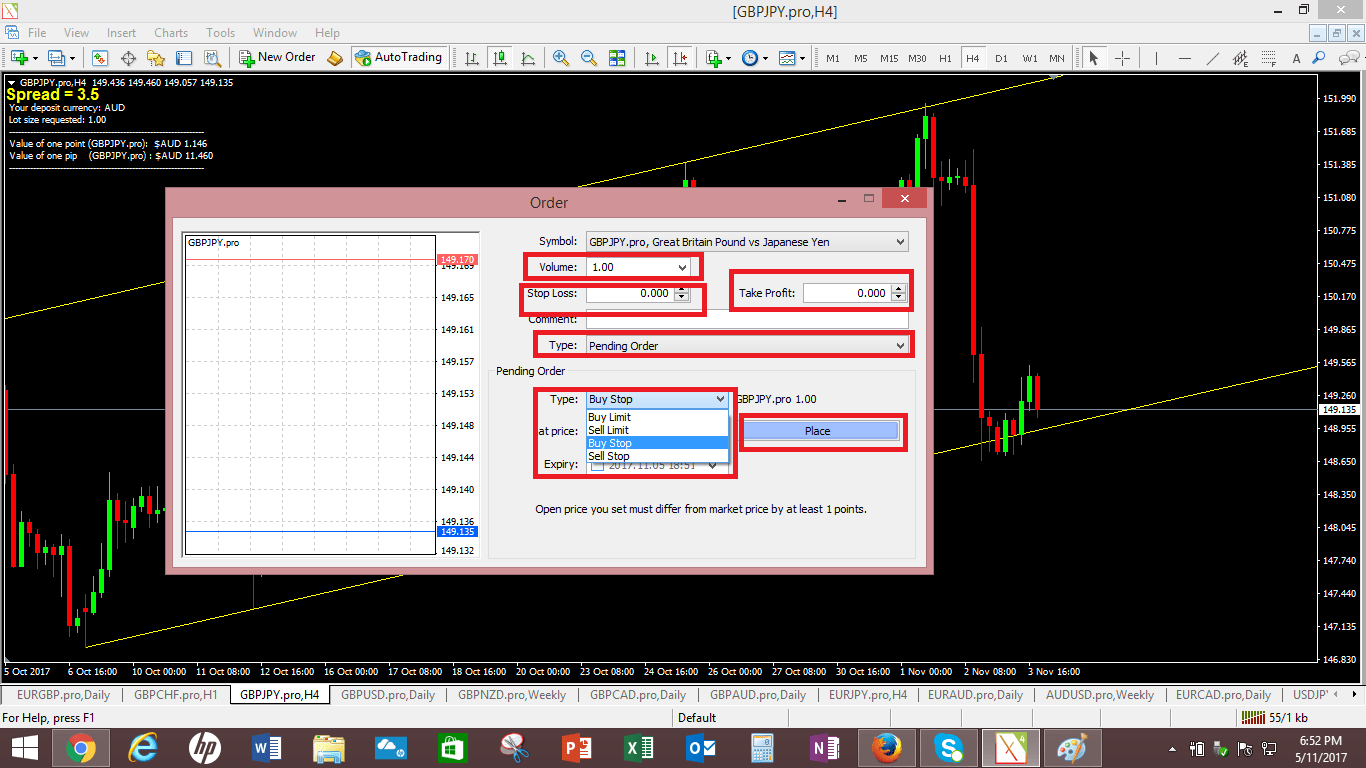

A “buy stop” buys something as soon as the price equals or exceeds a certain amount Say something is trading for $1 and you think it’s going to go up You don’t want to buy unless you have some evidence that what you thought is right So you coul. How to place trades in MT4 using Buy Stop, Sell Stop, Buy Limit or Sell Limit. Moving on, there is the stop limit order type Stop Limit Order Now, the stop limit is similar to the stop loss order However, you can also use this order type to buy stocks as well For example, let’s say you’re a momentum trader and you only want to buy stocks when they break out Here’s a look at where the stop limit order would.

A limit order lets you set a minimum price for the order to execute—it will only execute at. Limit order is placed at a maximum or minimum price at which a trader would like to buy or sell A buy limit order is placed above the current price A sell limit order is placed below the current price Stop order is placed at the specific price where you want to buy or sell. A buy limit order is used when an investor wants to open a long position in a stock at a certain price, while a stop order is used by an investor who wants to lock in profits or limit losses by.

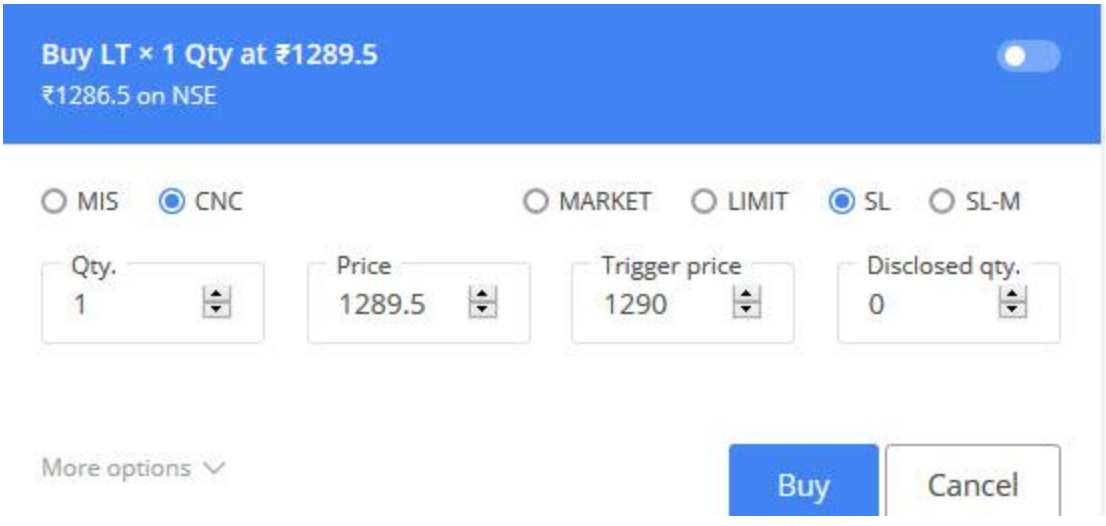

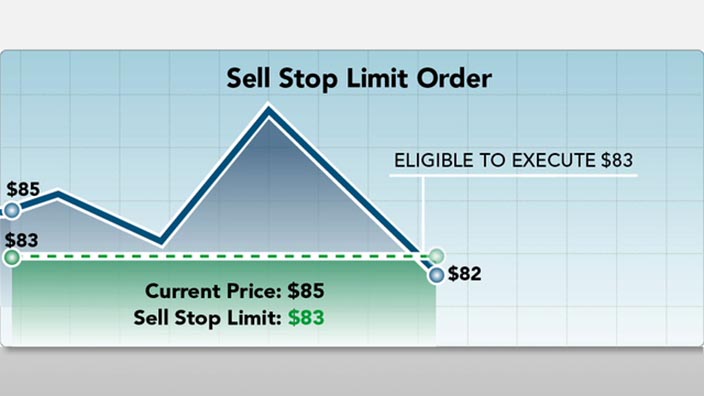

A stoplimit order is technically two order types combined, having both a stop price and limit price that can either be the same as the stop price or set at a different level When the stop price. An LIT order is similar to a stop limit order, except that an LIT sell order is placed above the current market price, and a stop limit sell order is placed below Using a Limit if Touched order helps to ensure that, if the order does execute, the order will not execute at a price less favorable than the limit price. On the order form panel, you can choose to place a market, limit, or stop order A market order will execute immediately at the best available current market price ;.

A limit order places an order on the order book in hopes that it’ll be filled by someone else’s market order A sell limit order is called an “ask” and a buy limit order is called a “bid” Limit order will “fill” as market orders buy or sell into limit orders The “last” order filled is the market price. A buy stop order is triggered when the stock hits a price, but if its moving faster than expected, without a limit price you may end up paying quite a bit more than you anticipated when you first. Difference between buy/sell stops & buy/sell limits 34 replies Why there is difference between buy limit and buy stop?.

A Stop order is a type of validity instruction and is similar to a Limit order where a buyer or seller sets a specific price that they want the trade to be filled at Instead of setting a maximum or minimum price which is what a limit order does, the trade will be immediately executed at the stop price;. 37 replies Difference between stoporders and limitorders 9 replies Auto SL/TP & buy limit, sell limit/buy stop, sell stop EA/indi 2 replies difference between limit and stop orders 4 replies. A limit order is visible to the market and instructs your broker to fill your buy or sell order at a specific price or better A stop order isn't visible to the market and will activate a market.

Sell Limit – an order to open a Sell position at a price higher than the current price level As a rule, Stop orders are placed when the current trend is expected to continue and Limit orders when the market is expected to move in the opposite direction. If the price is currently $40 and you submit a stoplimit order to sell at $36, it will wait until the price falls to $36 before. For buy orders, this means buy at the limit price or lower, and for sell limit orders, it means sell at the limit price or higher A stop order, sometimes called a stoploss order, is used to limit losses;.

A stoplimit order consists of two specified prices the stop price, which will be the trigger that converts the stoplimit order to a sell order, and the limit price Unlike a stoploss order that immediately becomes a market order, a stoplimit order goes through a couple of phases First, it converts to a sell order. A buy limit order is an order to purchase an asset at or below a specified maximum price level A buy limit, however, is not guaranteed to be filled if the price does not reach the limit price or. New comment 24 fallequinox 2123 After you stop laughing at how new I am please share with me what the difference is between a pending buy stop and a pending buy limit OP_BUY 0 Buying position OP_SELL 1 Selling position OP_BUYLIMIT ???.

The investor could further qualify the order by making it a buy stop limit If so, it is still triggered at the first price at or above the order price – $6210 – but then executes only after the price drops below $62 to $6195, since this is the first price at or below the buyer’s limit price. A sell stop limit order is placed below the current market price When the stop price is triggered, the limit order is sent to the exchange and a sell limit order is now working at, or higher than, the price you entered A buy stop limit order is placed above the current market price. A buy stop you would use on a breakout trade whereas a buy limit you would use if you were looking for the pair to bounce off a certain level but continue going long after the retracement Dont make it harder then it has to be.

Have questions, please comment on this video and we will answer them!Join BK Forex Academy https//bitly/2HY2qeN Daily Coaching, Tips, & Trade Ideas Bria. The investor could further qualify the order by making it a buy stop limit If so, it is still triggered at the first price at or above the order price – $6210 – but then executes only after the price drops below $62 to $6195, since this is the first price at or below the buyer’s limit price. Accordingly, a stop order is placed at $1,695―50 ticks from the bullish trade’s entry point If price retraces to $1,695, the stop order will be activated and the bullish position immediately closed out When it comes to risk management, the stop order versus limit order comparison is moot.

Source StreetSmart Edge® The above chart illustrates the use of market orders versus limit orders In this example, the last trade price was roughly $139 A trader who wants to purchase (or sell) the stock as quickly as possible would place a market order, which would in most cases be executed immediately at or near the stock’s current price of $139—providing that the market was open. A StopLimit order is an instruction to submit a buy or sell limit order when the userspecified stop trigger price is attained or penetrated The order has two basic components the stop price and the limit price When a trade has occurred at or through the stop price, the order becomes executable and enters the market as a limit order, which. With a limit buy price of $4250, the trade will only be completed if the fill price is $4250 or lower Limit buy orders are favorable because the worst price you can get filled at is the price you specify, and there's always a chance you get filled at an even better (lower) price.

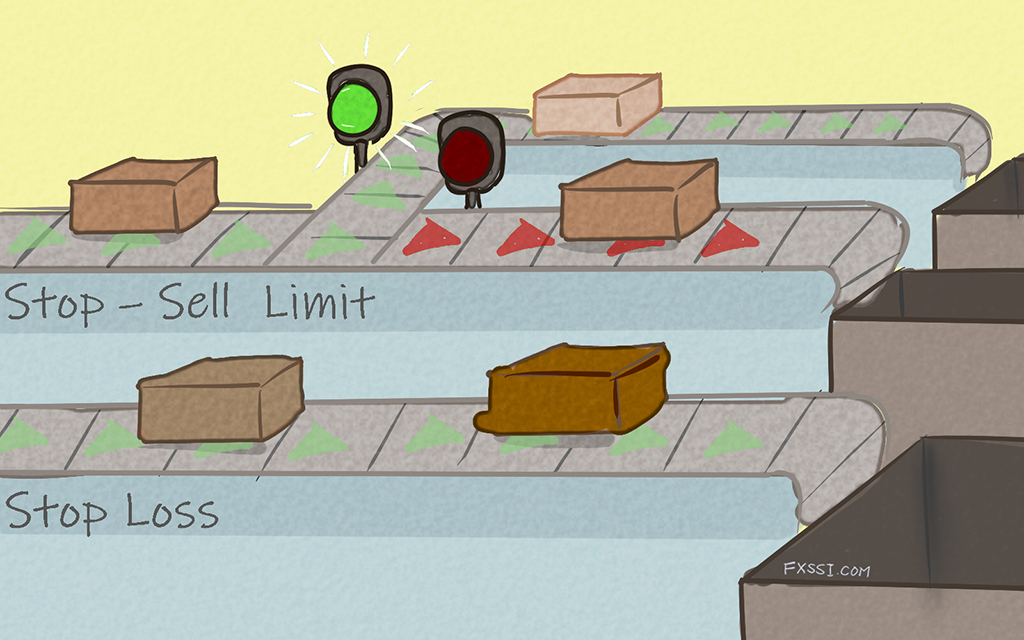

It instructs the broker to execute a trade when a stock reaches a price beyond which the investor is unwilling to sustain losses For buy orders, this means buying as soon as the price climbs above the stop price. Moving on, there is the stop limit order type Stop Limit Order Now, the stop limit is similar to the stop loss order However, you can also use this order type to buy stocks as well For example, let’s say you’re a momentum trader and you only want to buy stocks when they break out Here’s a look at where the stop limit order would. 3 StopLimit Orders Stoplimit orders act as a hybrid between stop market orders and limit orders These orders are executed at a specific price or better after a stop price is reached This means that a trader must define a stop price as well as the limit value Stoplimit orders provide traders with greater control over order entry, but.

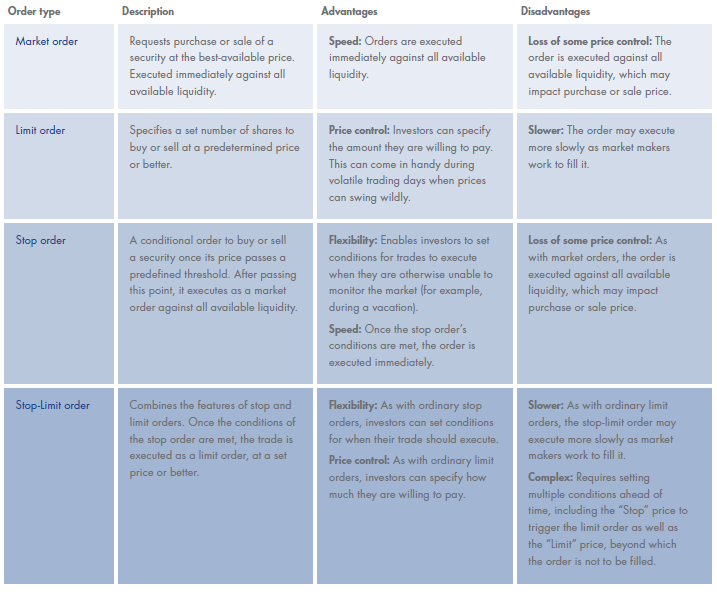

What is Buy / Sell Stop and Limit Explained – Order Types in Forex Trading By Daffa Zaky August 17, 16, 157 am • Posted in Education In forex , different trade orders are used to initiate. Limit orders are used to buy and sell a stock, while stoplimit orders set two prices on the stock and one is a stop price that states what price the stock must hit for the order to become active They each have their own advantages and disadvantages, so it's important to know about each one. Stop Limit Order is an order (buy/sell) to close a position that only executes when the current market price of an option/stock hit or passes through a predetermined price (ie Stop Price) Once the Stop Price is passed, the Stop Order becomes a Limit Order, and can only be executed at a specific price (ie Limit Price) or better As you may have noticed, Stop Limit Order is almost similar.

A buy stop order is triggered when the stock hits a price, but if its moving faster than expected, without a limit price you may end up paying quite a bit more than you anticipated when you first. You would use a limit order if you want to BUY a stock at a specific price or better Example Let’s say you want to buy Apple (AAPL), and you don’t want to pay more than $250 for the stock. The investor could further qualify the order by making it a buy stop limit If so, it is still triggered at the first price at or above the order price – $6210 – but then executes only after the price drops below $62 to $6195, since this is the first price at or below the buyer’s limit price.

A buy stop order is an order to buy a security, much like the ‘default’ buy limit order Put simplest, a buy stop is an order to buy a security at a higher price than the current market price The order sits idly in the market until the price of the security reaches the stop price, at which point, the order is activated and becomes a market. You would use a limit order if you want to BUY a stock at a specific price or better Example Let’s say you want to buy Apple (AAPL), and you don’t want to pay more than $250 for the stock. As with all limit orders, a stoplimit order may not be executed if the stock’s price moves away from the specified limit price, which may occur in a fastmoving market The stop price and the limit price for a stoplimit order do not have to be the same price For example, a sell stop limit order with a stop price of $300 may have a limit.

Limit orders are used to buy and sell a stock, while stoplimit orders set two prices on the stock and one is a stop price that states what price the stock must hit for the order to become active They each have their own advantages and disadvantages, so it's important to know about each one. A stoplimit order consists of two specified prices the stop price, which will be the trigger that converts the stoplimit order to a sell order, and the limit price Unlike a stoploss order that immediately becomes a market order, a stoplimit order goes through a couple of phases First, it converts to a sell order. Limit Order A limit order is also called a stop limit order It is a type of trading action that combines two kinds of orders In this initiative, an order is made to buy or sell a stock at a designated price or at better value to the investor First, investors assign a stop price Then they assign a limit order value If the action is buying.

A buy stop order is triggered when the stock hits a price, but if its moving faster than expected, without a limit price you may end up paying quite a bit more than you anticipated when you first. Most brokerage trading platforms offer five types of orders market, limit, stop, stop limit, and trailing stop A buy limit order is a limit order to buy at a specified price A sell stop order is. A buy stoplimit order involves two prices the stop price, which activates the limit order to buy, and the limit price, which specifies the highest price you are willing to pay for each share By placing a buy stoplimit order, you are telling the market maker to buy shares if the trade price reaches or exceeds your stop price¬—but only if.

Accordingly, a stop order is placed at $1,695―50 ticks from the bullish trade’s entry point If price retraces to $1,695, the stop order will be activated and the bullish position immediately closed out When it comes to risk management, the stop order versus limit order comparison is moot. Think of the stop price as a trigger. A stop order lets you specify the price at which the order should execute If it falls to that price, your order will trigger a sell;.

Diff between Buy Stop and Buy Limit??. Think of the stop price as a trigger. The Differences Between a StopLoss Order & a Limit Order By Doreen Martel Stoploss orders and limit orders can have a big impact on final pricing of stock trades.

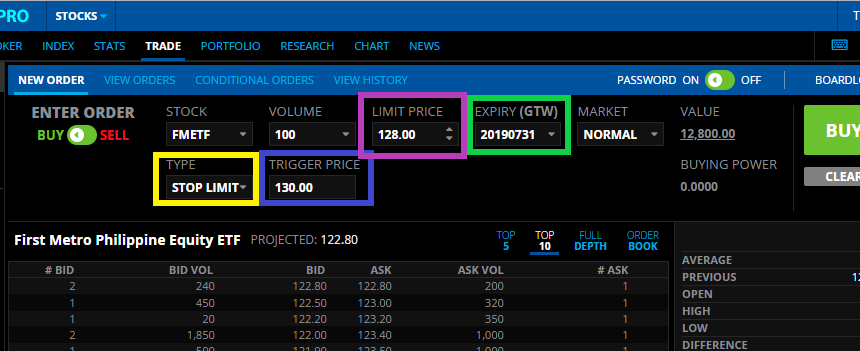

“Buy Stop Limit” order is the combination of the two order types which are “Buy Stop” and “Buy Limit”, as in being a stop order to place a Buy Limit order Please refer to the chart on the upperright side of the below photo. A buy limit is used to buy below the current price while a buy stop is used to buy above the current price They are pending orders for a buy in Forex Trading (and other financial trades) if you don’t want to buy at the current market price or you want to buy when the price changes to a certain direction. Source StreetSmart Edge® The above chart illustrates the use of market orders versus limit orders In this example, the last trade price was roughly $139 A trader who wants to purchase (or sell) the stock as quickly as possible would place a market order, which would in most cases be executed immediately at or near the stock’s current price of $139—providing that the market was open.

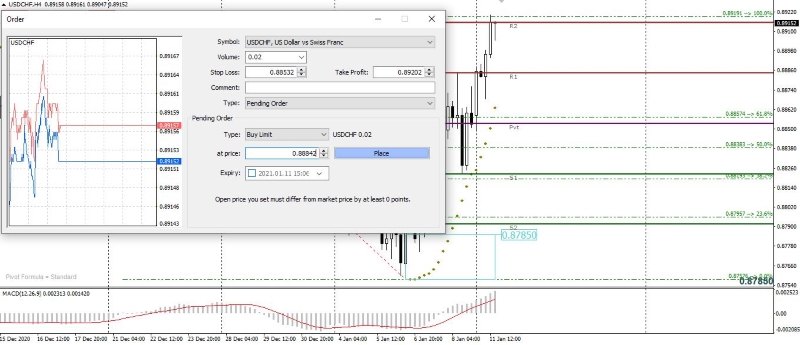

For example, there also exist Buy Stop Limit Order and Sell Stop Limit Order that are not available in MT4 Now back to the abovementioned difference between Limit and Stop orders If you want to make a buy trade, you may open both Buy Stop and Buy Limit orders In this case, the first is set above the current price, and the second – below it. Sell Limit – an order to open a Sell position at a price higher than the current price level As a rule, Stop orders are placed when the current trend is expected to continue and Limit orders when the market is expected to move in the opposite direction. A “buy stop” buys something as soon as the price equals or exceeds a certain amount Say something is trading for $1 and you think it’s going to go up You don’t want to buy unless you have some evidence that what you thought is right So you coul.

The Differences Between a StopLoss Order & a Limit Order By Doreen Martel Stoploss orders and limit orders can have a big impact on final pricing of stock trades. Learn everything about MT4 order types like buy stop, sell stop, sell limit, buy limit, mt4 market buy order and market sell order in this post You see, the MT4 trading platform really makes orders so easy in that there are only 2 Main Types of MT4 orders Pending orders (there are 4 types buy stop, sell stop, sell limit, buy limit). Limit = Reverse, meaning buy limit is I want the price to go down, hit my order and “reverse” back up, therefore my buy order has to be below current market price Same for sell pending orders Stop = Through, meaning buy stop is I want the price to go up, hit my order and keep going up ie, go “through” my order, therefore my buy order has to be above the current market price.

A sell stop limit order is placed below the current market price When the stop price is triggered, the limit order is sent to the exchange and a sell limit order is now working at, or higher than, the price you entered A buy stop limit order is placed above the current market price. Learn everything about MT4 order types like buy stop, sell stop, sell limit, buy limit, mt4 market buy order and market sell order in this post You see, the MT4 trading platform really makes orders so easy in that there are only 2 Main Types of MT4 orders Pending orders (there are 4 types buy stop, sell stop, sell limit, buy limit). 2 Buy limit pending position.

Buy Limit – an order to open a Buy position at a lower price than the current price level;.

Etf 104 Getting The Most Out Of Your Etf Trades Vaneck

How To Trade With Priceaction Master Woods14 By Patthawan Moo Issuu

What Is The Difference In Order Types Begin To Invest

Stop Loss Vs Stop Limit Orders What Is The Difference Between Them Which One Should You Use

What Is Metatrader 4 Mt And How Do You Use It Ig Au

Forex Blog Get Access To Alphaex Capital S Content For Free

Q Tbn And9gcqnufppkv5kzwbyoovci2vhhcgn7ae3c38cyx6waqrvjotxbpwz Usqp Cau

How Do I Use Stop Limit For Buying Firstmetrosec Help Center

Market Order Vs Limit Order Top 4 Best Differences Examples

Primary Order Types Contracts For Difference Com

Buy Stop Vs Buy Limit

Forex Crypto Order Types The Main Difference Between Stop Limit Market Simple Explanation Youtube

What Is The Difference Between A Stop Order And A Stop Loss Order Quora

Index Of Wp Content Uploads 16 08

Xm Asia The Differences Between Buy Limit Sell Limit Facebook

Stop Loss Vs Stop Limit Drone Fest

Buy Limit And Buy Stop Difference In Forex

Trigger Price In Zerodha Set Price By Kite For Cover Bracker Order

Buy Stop And Buy Limit Sell Stop And Sell Limit Pending Orders On Metatrader 4

:max_bytes(150000):strip_icc()/GettyImages-956752490-f855ea697f214f07b13b777eb4787945.jpg)

Buy Limit Vs Sell Stop Order What S The Difference

Binance Limit Vs Market Vs Stop Limit Order Understanding The Difference Cexcashback

Limit Order Vs Stop Order What Is The Difference Between Them Fxssi Forex Sentiment Board

Limit Order Vs Stop Order Difference And Comparison Diffen

Difference Between Sell Limit And Sell Stop Forex Golden Goose Method Any Guitar Chords

Mastering The Order Types Stop Limit Orders Charles Schwab

Difference Between Buy Limit And Buy Stop In Forex Opinapka S Blog

Types Of Forex Orders Market Limit And Stop Buy And Sell Orders Liteforex

Making Use Of Stop Loss Orders Contracts For Difference Com

Difference Between Limit Order And Stop Order Whyunlike Com

Major Difference Between Stop Order And Limit Order Street Finance

Difference Between Stop Orders And Limit Orders Forex Factory

How To Start Trading Types Of Orders Fx Trading Forex Com

Meraup Untung Dengan Forex Copy Trade Apa Itu Buy Limit Sell Limit Buy Stop Dan Sell Stop

What Is The Difference Between Stop Loss Sl And Sell Limit Sl Tani Forex Basics Tutorial Youtube

What Are The Difference Between Stop Loss And Stop Limit Order By Btcc Btcc Blog Oct Medium

Q Tbn And9gcsftoitva3ru3ih0b7wi9kx7n1wfbcgrcj7mynsvsb Kn9lzynu Usqp Cau

Limit Order Vs Stop Order Difference And Comparison Diffen

3 Order Types Market Limit And Stop Orders Charles Schwab

Buy Stop And Buy Limit Sell Stop And Sell Limit Pending Orders On Metatrader 4

Types Of Forex Orders Babypips Com

Trading Up Close Stop And Stop Limit Orders Youtube

Types Of Forex Orders Market Limit And Stop Buy And Sell Orders Liteforex

Top 10 Questions Of Online Forex Traders Answered Faq Fxpro Hercules Finance

How Does A Stop Order And A Stop Limit Order Differ

Types Of Orders Trading Principles Metatrader 5 Iphone Ipad Help

What Is Metatrader 4 Learn How To Use Mt4 With Tutorial

The Difference Between Market Limit And Stop Orders When Trading Crypto By Neuryx Club Support Neuryx Club Medium

Types Of Forex Orders Babypips Com

Buy Stop Buy Limit Forex Weird Forex Orders

Stop Loss And Guaranteed Stop Loss Orders Contracts For Difference Com

Limit Order Vs Stop Order Difference And Comparison Diffen

Buy Limit Order Definition And Example

Difference Between Sell Limit And Sell Stop Forex Golden Goose Method Any Guitar Chords

Buy Stop And Buy Limit Sell Stop And Sell Limit Pending Orders On Metatrader 4

What Are Stop Loss Orders And How To Use Them

Difference Between Buy Limit And Buy Stop In Forex Trading Fbs Forex Bonus 123 Weirdo Eu

Forex Basics Order Types Margin Leverage Lot Size By Colibri Trader Medium

What Is The Difference Between A Limit And A Stop Order

Trading Order Types Buy Stop Sell Stop Buy Limit Sell Limit And Market Orders

Q Tbn And9gcqh0n0tpega4qs Zrcshkqhr29wtsaguyyufpeabs8bqjcucd Usqp Cau

Q Tbn And9gcrlg L4 Uav R4 Cah0lyt15uwy4pbtxmtqowypmq8p6e570tbl Usqp Cau

Why My Pending Order Tp Or Sl Were Not Triggered Powered By Kayako Help Desk Software

Buy Stop Buy Limit Forex Come Fare Trading Con Le Opzioni Binarie

White Label Crypto Exchange Software Market Limit Stop Orders Antier Solutions

Fxpro You Ask What Is The Difference Between A Stop Facebook

What Are The Different Orders In Online Trading Trading Guides Capital Index

What Is A Buy Stop Order How To Trade With A Buy Stop Order On Mt4

Market Order Vs Limit Order Vs Stop Order What S The Difference

Buy Stop Vs Buy Limit

Buy Limit And Buy Stop Difference In Forex

Types Of Forex Orders Babypips Com

What Is The Difference Between Binary Options And Options Singapore

Whats The Difference Between Stop And Limit Orders

Types Of Forex Orders Babypips Com

Difference Between Buy Sell Stops Buy Sell Limits Forex Factory

Dec 31 Order Types Revisited Mediaserver Thinkorswim

The Difference Between Buy Sell Limit And Stop Orders Forex Made Simple

What Is The Difference Between Buy Limit And Buy Stop Youtube

/blur-1853262_19201-485cc15952974d8ab3af724fc5636238.jpg)

The Difference Between A Limit Order And A Stop Order

Trading Order Types Buy Stop Sell Stop Buy Limit Sell Limit And Market Orders

Difference Between Buy Sell Stops Buy Sell Limits Forex Factory

/stloplosslocationforlongtrade-59bd5b7f845b340011489d60.jpg)

Limit Order Vs Stop Entry Order Forex Fidelity Brokerage Account Minimum Investment Paramonas Villas

Publicly Traded Liquor Stocks Stop Order Stop Limit Order For Dummies Skupshtina Grada Zaјechara

Limit Order Vs Stop Order What S The Difference

Buy Stop Order Definition

Stop Limit Order How Does It Work When Should You Use It

Www Theice Com Publicdocs Futures Us Stop Limit Faq Pdf

Gx1rx Oxvvgslm

Trading Order Types Buy Stop Sell Stop Buy Limit Sell Limit And Market Orders

What Is A Stop Limit Order Fidelity

What Is The Difference Between Buy Limit And Buy Stop Youtube

Limit Order Vs Stop Order Difference And Comparison Diffen

Difference Between A Stop And Limit Order Warrior Trading

Learn The Difference Between A Stop Order And A Limit Order

Stop Loss Vs Stop Limit Orders The Difference Explained Fxssi Forex Sentiment Board

How To Types Forex Market Order Buy Limit Sell Limit Buy Stop Sell Stop Stop Loss Easy To Learn Youtube

Buy Limit Va Buy Stop

Forex Buy Limit Buy Stop The Difference Between A Limit Order And A Stop Order