Buy Limit Order Vs Buy Stop Order

How To Place Limit Orders And Stop Orders In Forex Learning Fx

Why Is My Forex Trade Executed Without Price Touching It

Know Your Entry Orders In Trading The Trend Trading Blog

What Is A Limit Stop Order Saxoinvestor Support

What Is A Stop Limit Order And When Should You Use It Thestreet

Risk Management Order Types Cfd Trading Singapore Phllip Cfd

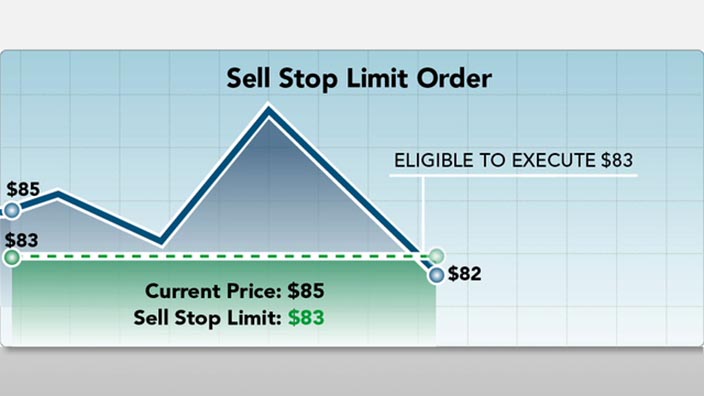

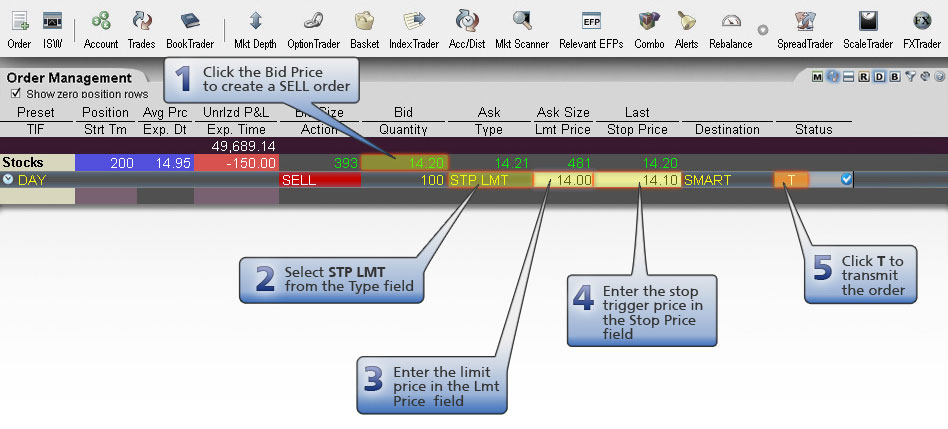

A stoplimit order is an order to buy or sell a stock that combines the features of a stop order and a limit order Once the stop price is reached, a stoplimit order becomes a limit order that will be executed at a specified price (or better).

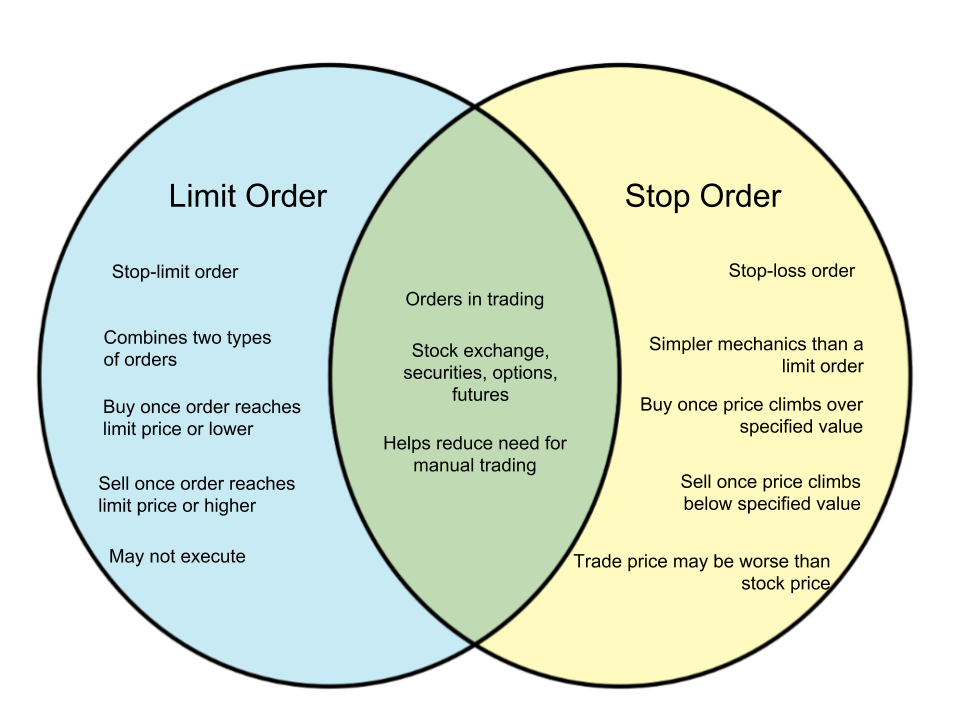

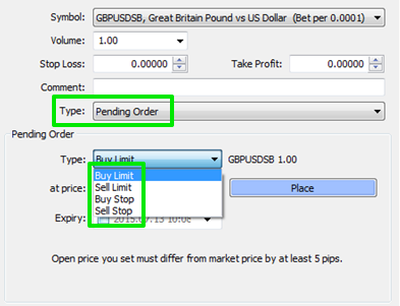

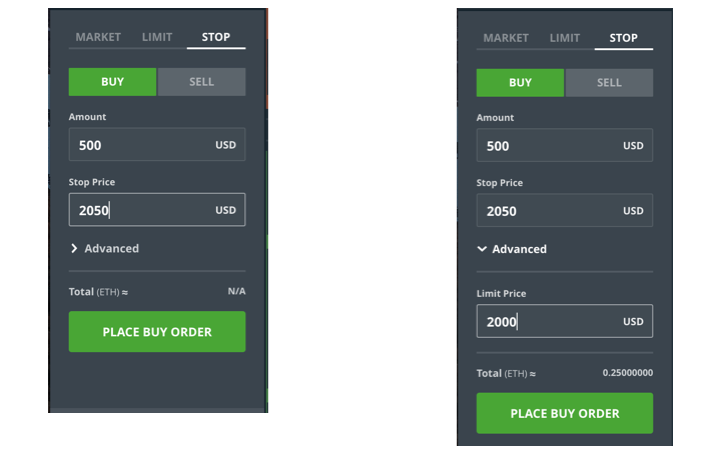

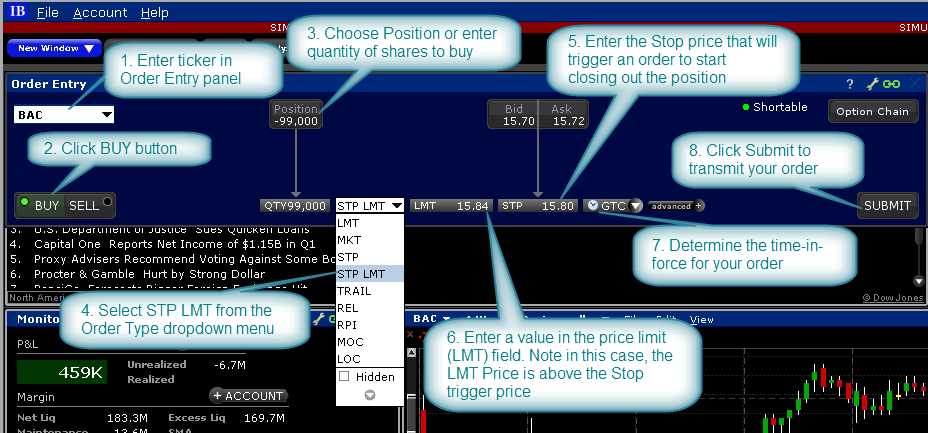

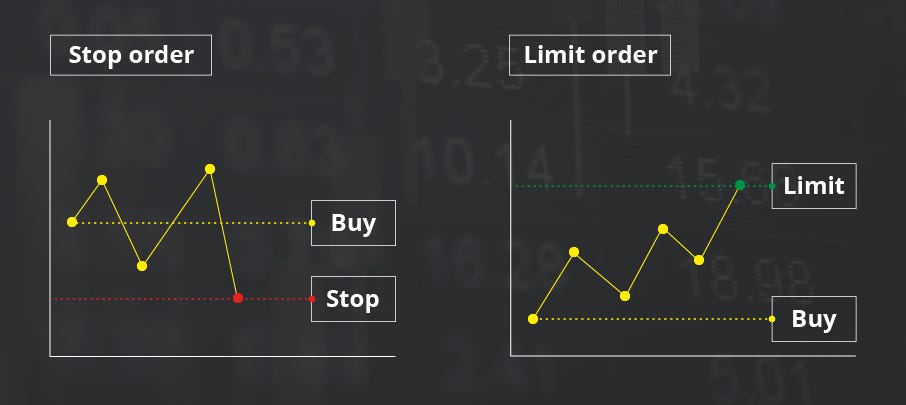

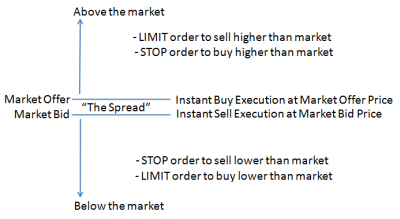

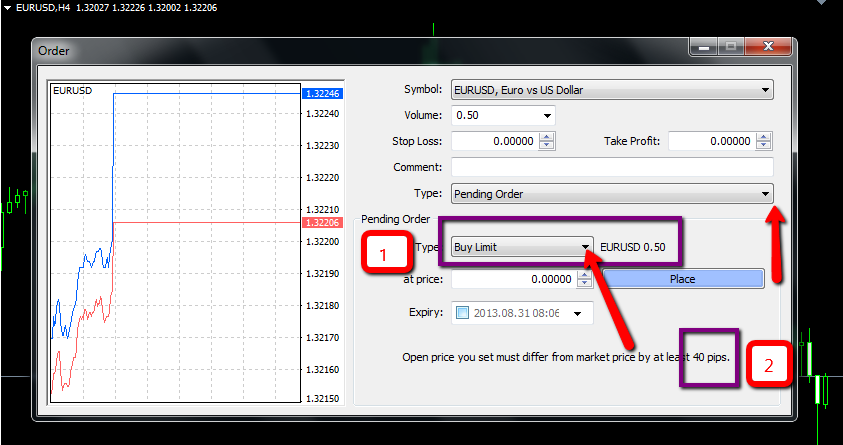

Buy limit order vs buy stop order. Stop Orders Stop orders allow customers to buy or sell when the price reaches a specified value, known as the stop price This order type helps traders protect profits, limit losses, and initiate new positions To place a stop limit order Select the STOP tab on the Orders Form section of the Trade View. Stop Orders Stop orders allow customers to buy or sell when the price reaches a specified value, known as the stop price This order type helps traders protect profits, limit losses, and initiate new positions To place a stop limit order Select the STOP tab on the Orders Form section of the Trade View. Limit orders can be seen by the market when placed, while stop orders are not visible until the stock reaches the stop price A stop order lacks the risk of a partial fill because it becomes a market order when the stock hits the stop price Stop order prices are the opposite of limit order prices.

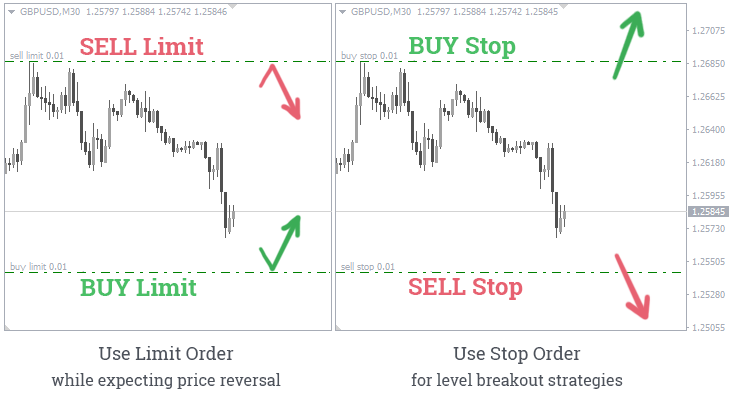

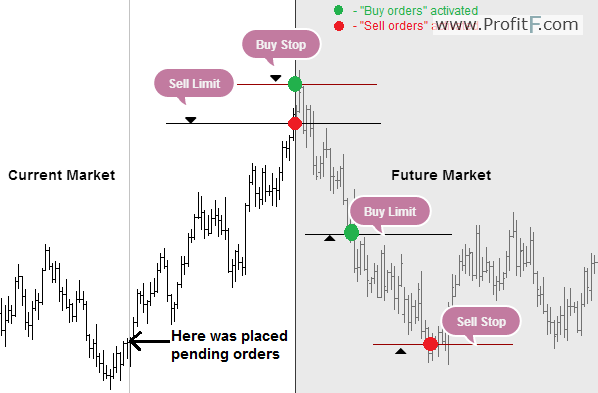

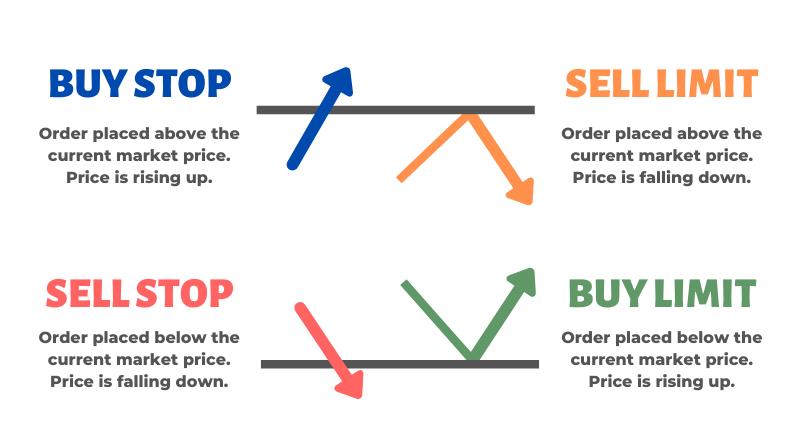

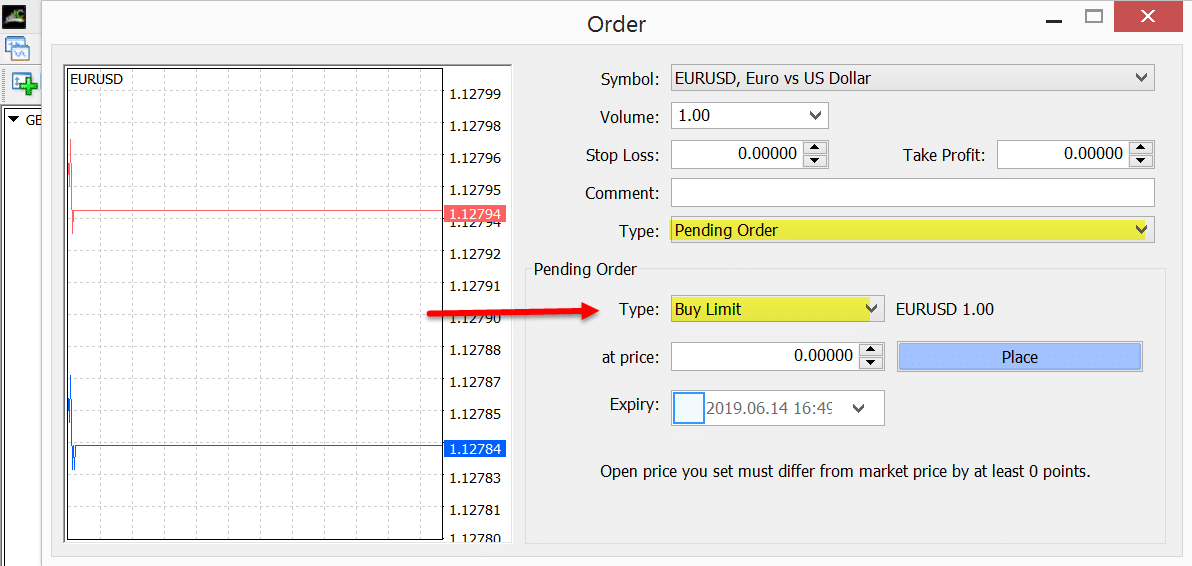

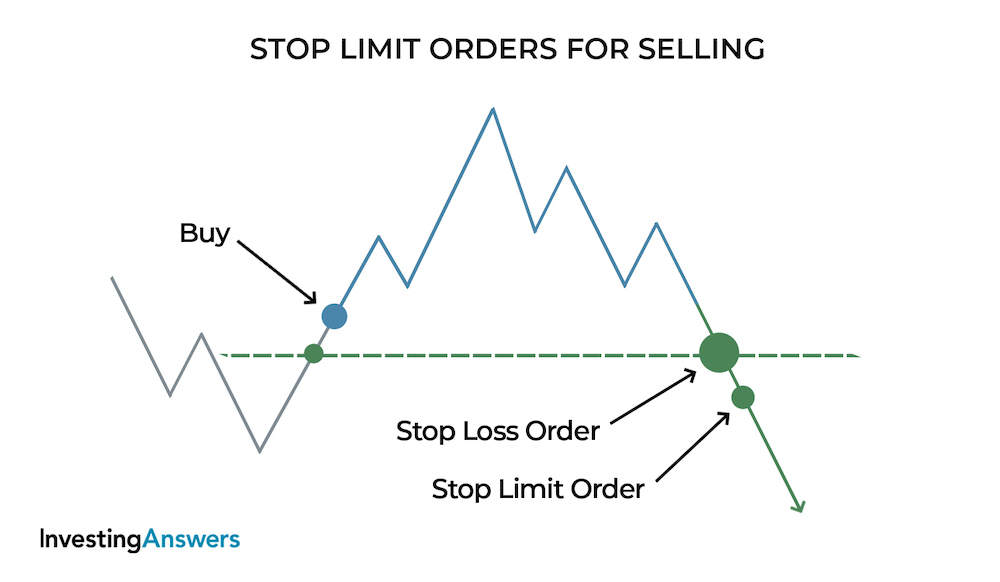

Conversely, traders also use stoplimit orders for exiting trades to help minimize risk and book profits Buy StopLimit Order vs Sell StopLimit Order A buy stoplimit order must be entered above the current market price, and a sell stoplimit order must be entered below the current market price If the stop price is not touched by the market. Limit orders aren’t subject to slippage and sometimes have lower fees than market orders You can set a limit buy or limit sell A stop order places a market order when a certain price condition is met So it works like a limit order, in that it goes on the books, but it executes like a market order once that price is reached (as a rule of thumb, there are stops that use limits). Limit order is placed at a maximum or minimum price at which a trader would like to buy or sell A buy limit order is placed above the current price A sell limit order is placed below the current price Stop order is placed at the specific price where you want to buy or sell.

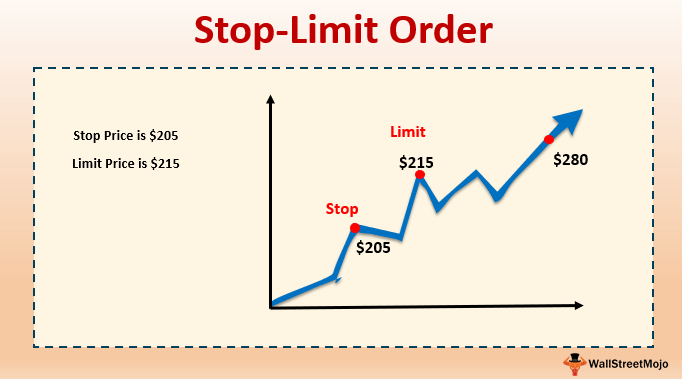

A buy stoplimit order involves two prices the stop price, which activates the limit order to buy, and the limit price, which specifies the highest price you are willing to pay for each share By placing a buy stoplimit order, you are telling the market maker to buy shares if the trade price reaches or exceeds your stop price¬—but only if. Stop order vs limit order A stop order (also called a stoploss order) is an order to buy or sell a stock at the time when the price reaches a particular threshold, called the “stop price” The stop price acts as a trigger that turns a stop order into a market order, at which time the broker proceeds with finding the best available market. A buy limit is the same, but in reverse order You are looking to enter at a price that is below the current price and for price to then move back higher in your favor Using Buy Limit and Buy Stop Orders Buy Limit A buy limit is an order to buy at a level below the current price.

A limit order to BUY at a price below the current market price will be executed at a price equal to or less than the specified price A limit order to SELL at a price above the current market price will be executed at a price equal to or more than the specific price Stop Entry Order. Buy Stop Limit Order Example Buy Stop Limit Order Learn to Trade Stocks, Futures, and ETFs RiskFree In the above example, I am entering a buy stop limit order for the stock RHI In this example, RHI is currently bidding at $54 with an ask of $5214 Let’s say that I have my eyes on entering the trade, but not until RHI hits $53. To get the transcript and MP3, go to https//wwwrockwelltradingcom/coffeewithmarkus/stopordervslimitorderwhatsthedifference/There's a huge differ.

Limit orders are used to buy and sell a stock, while stoplimit orders set two prices on the stock and one is a stop price that states what price the stock must hit for the order to become active They each have their own advantages and disadvantages, so it's important to know about each one. For example, you could set a stoploss order for Stock B at $15 This means that if that stock ever climbs to $15, your portfolio will execute a market order to buy Stock B StopLimit Orders The stoplimit order exists to smooth out some of the unpredictability of a stoploss order. Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better;.

Buy limit orders are placed below the market price – a low price is a better price for the buyer Sell limit orders are placed above the market price – a high price is a better price for the seller Stop orders become market orders when triggered, executing at whatever the next price is. In this stock market order types tutorial, we discuss the four most common order types you need to know for buying and selling stocks market order, limit or. Whereas, once a stop order triggers at the specified price, it will be filled at the prevailing price in the market—which means that it could be executed at a price significantly different than the stop price.

Once the market reaches up the level of the limit order, the currency is sold at a profit but when he market falls, the stoploss order is used Stop Order The last one is Stop Order , which is an order to buy above the market or to sell below the market. A buy limit is used to buy below the current price while a buy stop is used to buy above the current price They are pending orders for a buy in Forex Trading (and other financial trades) if you don’t want to buy at the current market price or you want to buy when the price changes to a certain direction. Remember, with a limit order, you have to set the price to buy With a buy stop limit order, the limit order portion must be higher than the trigger portion of the order That said, you could have put a limit order at $115 You can see how much easier it becomes when you learn order types.

Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better;. A StopLimit order is an instruction to submit a buy or sell limit order when the userspecified stop trigger price is attained or penetrated The order has two basic components the stop price and the limit price When a trade has occurred at or through the stop price, the order becomes executable and enters the market as a limit order, which is an order to buy or sell at a specified price or better. Remember, with a limit order, you have to set the price to buy With a buy stop limit order, the limit order portion must be higher than the trigger portion of the order That said, you could have put a limit order at $115 You can see how much easier it becomes when you learn order types.

On Bybit, traders can use a Conditional Market or Conditional Limit Order to set up a Stop Entry Order For buy Stop Orders, the trigger price must be higher than the last traded price, while for sell stop orders, the trigger price must be lower than the last traded price. Limit Orders versus Stop Orders New traders often confuse limit orders with stop orders because both specify a price Both types of orders allow traders to tell their brokers at what price they’re willing to trade in the future The difference lies in the purpose of the specified price A stop order activates an order when the market price reaches or passes a specified stop price. Subscribe http//bitly/SubscribeTDAmeritrade When placing trades, the order type you choose can have a big impact on when, how, and at what price your ord.

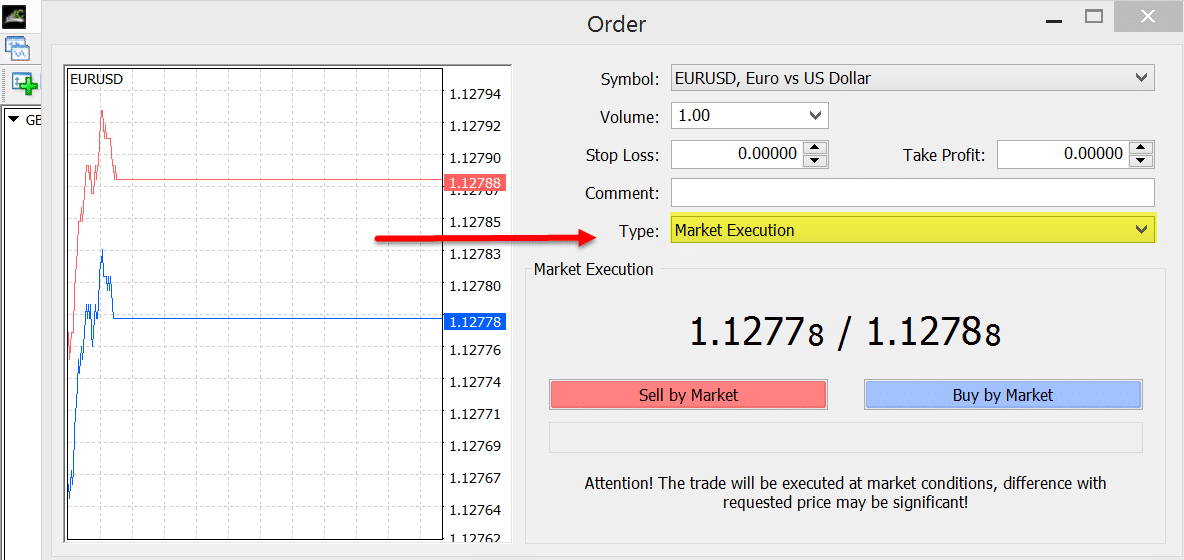

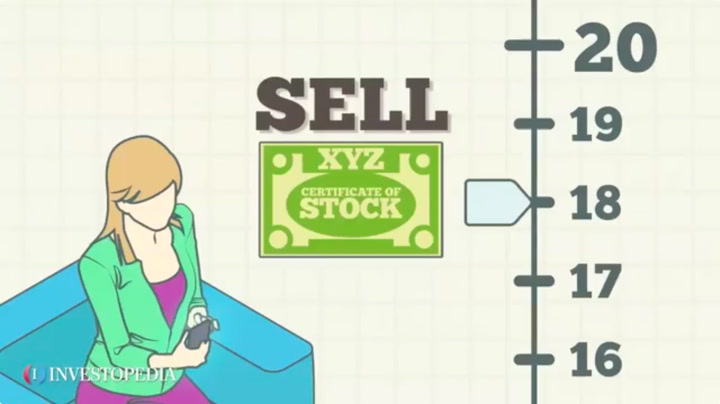

Limit and stop orders also have buy and sell subdivisions Market Execution Orders A market execution order is an instruction from the trader to the broker to execute a buy or sell order for a. If the share price increases in value from $16 (current stock price) to $1800 (stop price), the stop order will trigger, and as a result, a limit order will be created to buy 0 shares at $1850 (stoplimit) or less. Whereas, once a stop order triggers at the specified price, it will be filled at the prevailing price in the market—which means that it could be executed at a price significantly different than the stop price.

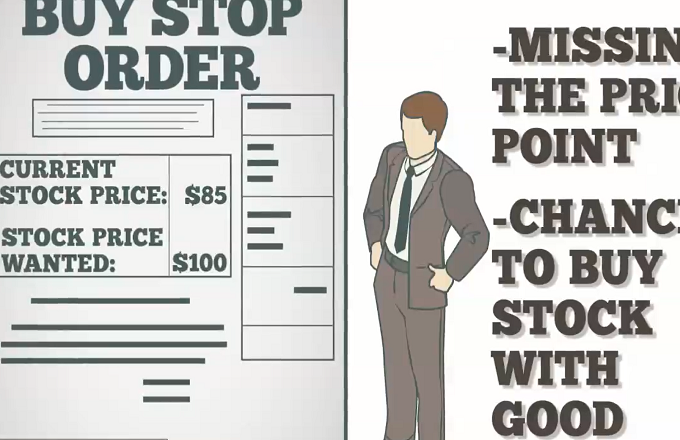

A buy stop order is triggered when the stock hits a price, but if its moving faster than expected, without a limit price you may end up paying quite a bit more than you anticipated when you first. It instructs the broker to execute a trade when a stock reaches a price beyond which the investor is unwilling to sustain losses For buy orders, this means buying as soon as the price climbs above the stop price. For over the counter (OTC) securities, a stop limit order to buy becomes a limit order, and a stop loss order to buy becomes a market order, when the stock is offered (National Best Offer quotation) at or higher than the specified stop price.

How Limit Orders Work Limit orders can be set for either a buying or selling transaction They serve essentially the same purpose either way, but on opposite sides of a transaction A limit order gets its name because using one effectively sets a limit on the price you are willing to pay or accept for a given stock. How Limit Orders Work Limit orders can be set for either a buying or selling transaction They serve essentially the same purpose either way, but on opposite sides of a transaction A limit order gets its name because using one effectively sets a limit on the price you are willing to pay or accept for a given stock. A stop order, also referred to as a stoploss order is an order to buy or sell a stock once the price of the stock reaches the specified price, known as the stop price When the stop price is reached, a stop order becomes a market order A buy stop order is entered at a stop price above the current market price Investors generally use a buy stop order to limit a loss or protect a profit on a stock that they have sold short.

Stoplimit orders have a given "stop" price while limit orders have "a specified price," and both sell or buy at this price point I suppose the difference could be the fact that before the stoplimit order is executed, it is a different type of order, but I don't see how there's a functional difference. Whereas, once a stop order triggers at the specified price, it will be filled at the prevailing price in the market—which means that it could be executed at a price significantly different than the stop price. Limit orders aren’t subject to slippage and sometimes have lower fees than market orders You can set a limit buy or limit sell A stop order places a market order when a certain price condition is met So it works like a limit order, in that it goes on the books, but it executes like a market order once that price is reached (as a rule of.

A stoplimit order is an order to buy or sell a stock that combines the features of a stop order and a limit order Once the stop price is reached, a stoplimit order becomes a limit order that will be executed at a specified price (or better). A limit order will set the maximum or minimum at which the trader is willing the buy or sell the particular stock or. For buy orders, this means buy at the limit price or lower, and for sell limit orders, it means sell at the limit price or higher A stop order, sometimes called a stoploss order, is used to limit losses;.

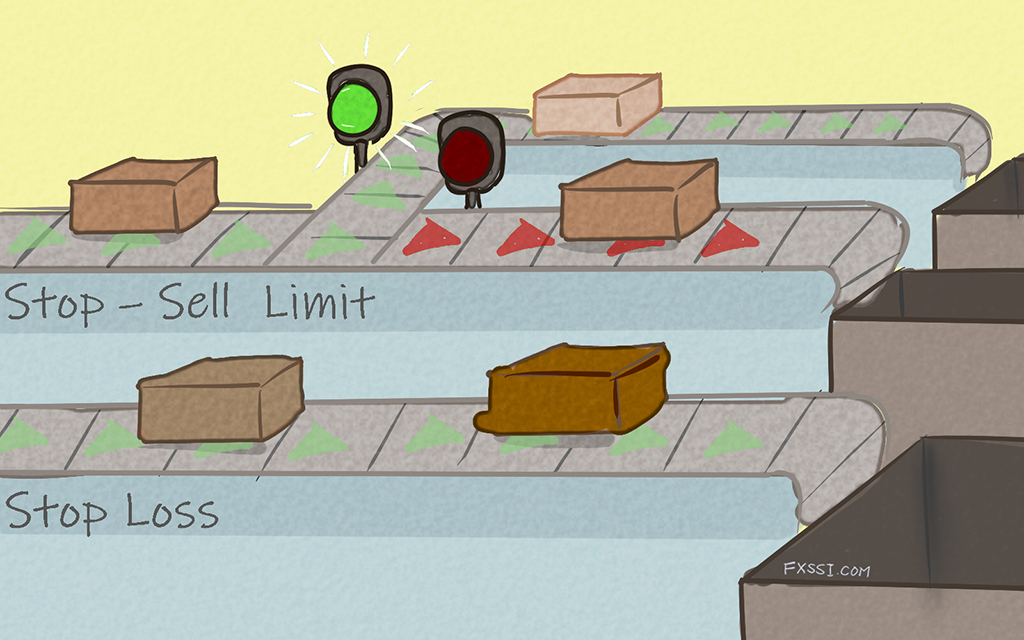

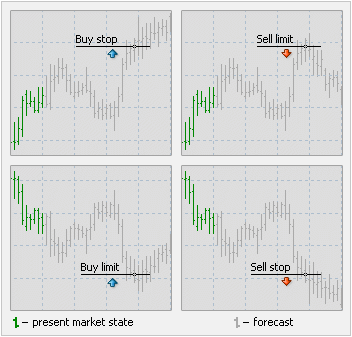

Pending order are used to catch the price move Pending orders are like trapsthey wait for price to come to them and hit them before these pending orders get activated Buy limit and sell limit orders are referred to as “limit orders” whereas buy stop and sell stop orders are referred to as ” stop orders”. Difference Between Market Order and Limit Order Market order refers to the order in which buying or selling of the financial instruments will be executed on the market price prevailing at that point of time, whereas, Limit order refers to that kind of an order that purchases or sells the security at the mentioned price or more better A market order is an order to buy or sell a stock at the. When an investor places an order to buy or sell a stock, there are a few various types of orders that can be placed, depending on an individual’s preferences Two commonly utilized methods of stock orders are stoploss and stoplimit StopLoss vs StopLimit Order The stoploss order is one of the most popular ways for traders to limit.

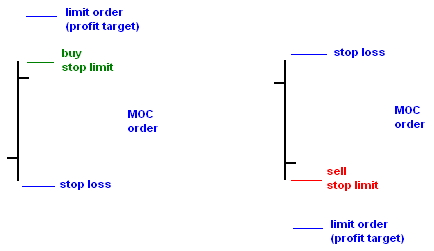

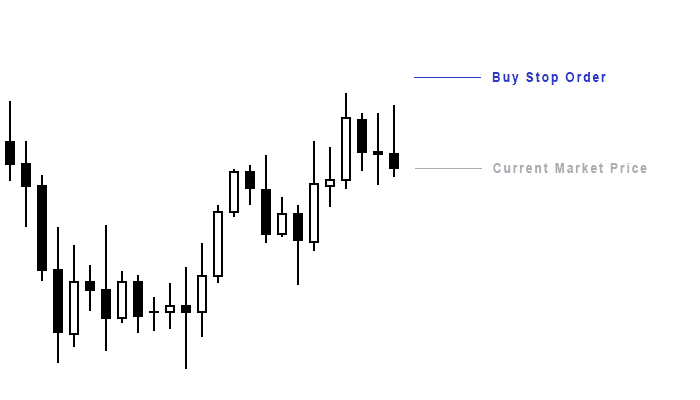

A sell stop limit order is placed below the current market price When the stop price is triggered, the limit order is sent to the exchange and a sell limit order is now working at, or higher than, the price you entered A buy stop limit order is placed above the current market price. Stu logs in to his trading platform and places a stopbuy limit order as follows Buy 0 XYZ at $18 stop, $1850 limit;. When a trader places a limit order manually on a trading DOM, it must be below current market price if a buy and above if a sell If not, the limit order is filled at market Stop orders A stop order, commonly known as a “stop loss,” is an order that ensures a trade’s exit upon a specific price level being hit A stop order is placed upon the market at a distinct price by the trader When it is hit, or “taken out,” a market order is initiated closing out the trade.

When you place a buy stop limit order when purchasing XYZ stock at $28, the order will only become active if the price moves higher than $28 If it becomes active, the order will only be executed at $28 or better Assuming you want to sell the XYZ stock if it trades to $19 At the moment, it is currently trading at $23. Pending orders are like trapsthey wait for price to come to them and hit them before these pending orders get activated Buy limit and sell limit orders are referred to as “limit orders” whereas buy stop and sell stop orders are referred to as ” stop orders”. If the price increases to, or up through, the stop price, that will trigger an order to buy A buy stoplimit order involves two prices the stop price, which activates the limit order to buy, and the limit price, which specifies the highest price you are willing to pay for each share.

Placing a "limit price" on a stop order may help manage some of the risks associated with the order type For a buy stop order, set the stop price above the current market price For a sell stop order, set the stop price below the current market price. A sell stop limit order is placed below the current market price When the stop price is triggered, the limit order is sent to the exchange and a sell limit order is now working at, or higher than, the price you entered A buy stop limit order is placed above the current market price. In addition, the stop orders are specifically helpful to investors that are unable to constantly monitor the market Moreover, some of the brokerages are offering the setup of a stop order for free What is a Limit order?.

How Limit Orders Work Limit orders can be set for either a buying or selling transaction They serve essentially the same purpose either way, but on opposite sides of a transaction A limit order gets its name because using one effectively sets a limit on the price you are willing to pay or accept for a given stock. If an investor expects the price of an asset to decline, then a buy limit order is a reasonable order to use If the investor doesn't mind paying the current price, or higher, if the asset starts. Stop Limit Order is a stop order that becomes a limit order after the specified stop price has been reached Stop Order is an order to buy securities at a price above or sell at a price below the current market The primary benefit of a stoplimit order is that the trader has precise control over when the order should be filled.

Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better;. Buy limit orders involve buying an asset at a set price or lower, while Sell limit orders involve selling an asset at the limit price or higher These orders are extremely useful to investors, and they are frequently used, as they play an important role in reducing the risks of trading, while securing profits. When a trader places a limit order manually on a trading DOM, it must be below current market price if a buy and above if a sell If not, the limit order is filled at market Stop orders A stop order, commonly known as a “stop loss,” is an order that ensures a trade’s exit upon a specific price level being hit.

How to type forex market orderbuy limitsell limitbuy stop sell stop stop lossvery easy to learnWelcome Friends to 's Biggest Technical Analysis Youtub. A buy stop order is triggered when the stock hits a price, but if its moving faster than expected, without a limit price you may end up paying quite a bit more than you anticipated when you first. A stoplimit order is an order to buy or sell a stock that combines the features of a stop order and a limit order Once the stop price is reached, a stoplimit order becomes a limit order that will be executed at a specified price (or better).

Order Types Market Limit Gtc Stop Loss Projectoption

What Is A Stop Limit Order Fidelity

Etf Order Types Back To The Basics Seeking Alpha

Q Tbn And9gcszh5pksd9wq52dvt4orw65hmf6t0bstz0m4685m8en Pq Wod Usqp Cau

Trailing Stop Loss Vs Trailing Stop Limit Which Should You Use

Stop Limit Order Strategy Forex Education

How To Use Sell Limit And Sell Stop Order Explained With Examples

Trading Order Types Explained Stop Limit And Instant Execution Trader S Nest

Stock Order Types Limit Orders Market Orders And Stop Orders Youtube

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape

Making Use Of Stop Loss Orders Contracts For Difference Com

5 Market Orders With Metatrader Dear Blackstone Futures Facebook

Stop Order Vs Stop Limit Order Which Is Best For Your Strategy Dttw

What Are Market Orders Limit Orders Stop Limit Orders Bitpanda Academy

Buy Limit And Buy Stop Difference In Forex

Types Of Order Stop Vs Limit Orders Ig Sg

What Is A Limit Order In Trading

Limit Order Vs Stop Order What Is The Difference Between Them Fxssi Forex Sentiment Board

What Is Trailing Stop Limit Orders And How They Work

Buy Stop Order Financial Definition Of Buy Stop Order

/stloplosslocationforlongtrade-59bd5b7f845b340011489d60.jpg)

Limit Order Vs Stop Entry Order Forex Fidelity Brokerage Account Minimum Investment Paramonas Villas

Buy Stop Limit Order Mt5 Greyed Out Why Forex

Why I Can T Place Buy Stop Sell Limit Orders On Mt4 Mt5 Platforms As They All Grayed Out Faq Hercules Finance

Q Tbn And9gcrjty9zjnmhkpk0zpy Lk5zr4lpub6w2rwzrkr10lak6werbol1 Usqp Cau

Stop Limit Orders How To Execute And Why Traders Use Them

Stop And Limit Orders Beginner Questions Babypips Com Forex Trading Forum

Q Tbn And9gctnbzqgquln6eurtp21uo4 8fuv4 tqvnilhvsqrg6wkwu25 Usqp Cau

Q Tbn And9gct1xko4nrpwajpr4qiav5dzzi7r8gs6nwdrmecqntaidbv3h7mg Usqp Cau

5 Best Order Types For Stock Trading Stocktrader Com

Sec Gov Investor Bulletin Stop Stop Limit And Trailing Stop Orders

Buy Limit Order Definition Examples How Does It Work

3 Order Types Market Limit And Stop Orders Charles Schwab

What Is An Entry Order Entry Orders Buy Stop Buy Limit Orders City Index Singapore

Stop Loss Vs Stop Limit Orders The Difference Explained Fxssi Forex Sentiment Board

Limit Order Example What Is A Limit Order

/blur-1853262_19201-485cc15952974d8ab3af724fc5636238.jpg)

The Difference Between A Limit Order And A Stop Order

Trading Order Types Buy Stop Sell Stop Buy Limit Sell Limit And Market Orders

Demystifying Order Types Market Order Vs Limit Order

Stop Limit Orders Interactive Brokers Llc

What Is The Difference Between A Stop Order And A Stop Loss Order Quora

Difference Between Limit Order And Stop Order Whyunlike Com

Limit Order Vs Stop Order Difference And Comparison Diffen

What Is A Stop Limit Order In Futures Trading Ninjatrader Blog

Frm Order Types Market Limit Stop Stop Limit Youtube

3 Basic Order Types Explained Ninjatrader Blog

Trading Order Types Explained Stop Limit And Instant Execution Trader S Nest

Maybank Kim Eng Ezy Trade

Oco And Oso Templates

Buy Stop Vs Buy Limit

Types Of Order Stop Vs Limit Orders Ig Sg

Limit Order What Is It And How To Use It

Knowledge For Traders Placing Stop Loss Orders Wikifolio Com

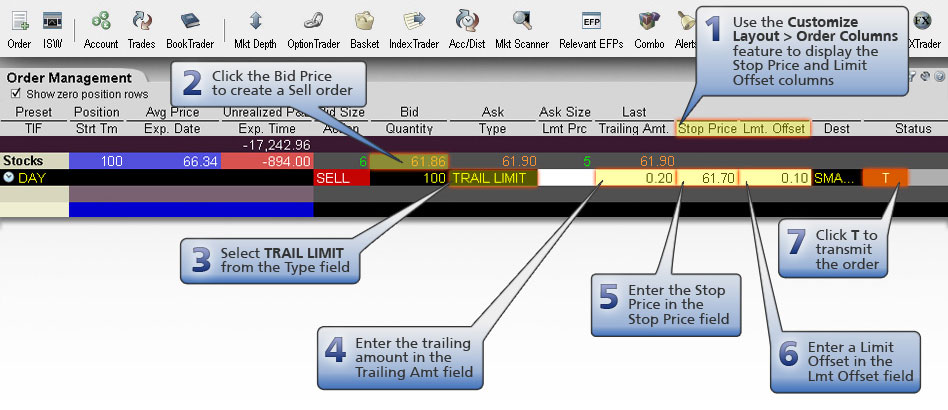

Trailing Stop Limit Orders Interactive Brokers Llc

Types Of Forex Orders Babypips Com

Learn How To Trade On Binance And Put Market Limit Stop Orders

Stop Orders Available On Gdax Stop Market And Stop Limit Orders Are By Adam White Medium

How To Start Trading Types Of Orders Fx Trading Forex Com

Buy Limit Vs Buy Stop Stuff To Buy Market Price Limits

Primary Order Types Contracts For Difference Com

What Does Buy On Stop Mean Cabot Wealth Network

Stop Limit Orders Interactive Brokers Llc

How To Use Buy Limit And Buy Stop Order Explained With Examples

Attached Stop Order Settings

Buy Stop Vs Buy Limit

How To Set Limit And Stop Orders In Margin Trading By Bex500 Exchange Bex500 School Medium

Limit Order Vs Stop Order What Is The Difference Between Them Fxssi Forex Sentiment Board

In Trailing Stop Limit Orders What Does The Limit Offset Mean Economics Stack Exchange

Primary Order Settings

Market Stop Loss Or Stop Limit Know When To Use Which Order For Stocks The Financial Express

Order Types That Prime Xbt Offers By Primexbt Prime Xbt Blog Has Moved To Primexbt Com Blog Medium

Types Of Forex Orders Babypips Com

What Is Buy Stop Limit Order On Mt4 Mt5 Platforms How Does It Work Faq Hercules Finance

Types Of Forex Orders Babypips Com

Example Of A Buy Limit And A Buy Stop Limit Orders General Mql5 Programming Forum

Buy Limit How Do I Get A Buy Limit Order

Market Order Vs Limit Order Top 4 Best Differences Examples

Forex Order Types Explained And How To Use Them Optimizefx Com

Types Of Order Stop Vs Limit Orders Ig Sg

Stop Limit Order Definition Example How Does It Work

What Is Trailing Stop Limit Orders And How They Work

Jbreakouttrader Automated Price Range Breakout Trading With Interactive Brokers

What Does Trailing Stop Buy Order On Bitstamp Mean Bitcoin Stack Exchange

Buy Stop And Buy Limit Sell Stop And Sell Limit Pending Orders On Metatrader 4

Stop Limit Order Examples Meaning Investinganswers

6 Mt4 Order Types Sell Stop Buy Stop Buy Limit Sell Limit Market Order

Buy Limit And Buy Stop Difference In Forex

Stop Loss Limit Take Profit Limit Two New Advanced Orders Go Live On Kraken Kraken Blog

What Is Buy Stop Limit Order On Mt4 Mt5 Platforms How Does It Work Faq Hercules Finance

How To Use Sell Limit And Sell Stop Order Explained With Examples

Trading Order Types Explained Stop Limit And Instant Execution Trader S Nest

Buy Stop Order Definition

Difference Between Stop Orders And Limit Orders Forex Factory

Long Or Short Daily Price Action

How Does A Stop Order And A Stop Limit Order Differ

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape

Learn Trading Strategies Difference Between Buy Limit And Buy Stop Order

The Etf Problem With Stop Loss Market Orders

Types Of Trade Orders For Retail Traders